Starwood 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$40 million, a debt service guarantee during the term of the senior debt, which was limited to the interest expense on

the amounts drawn under such debt and principal amortization and a completion guarantee for this project. The fair

value of these guarantees of $3 million is reflected in other liabilities in the accompanying consolidated balance

sheets at December 31, 2006 and 2005. In January 2007 this hotel was sold and the senior debt was repaid in full. In

addition, the $28 million in mezzanine loans and other investments, together with accrued interest, was repaid in

full. In accordance with the management agreement, the sale of the hotel also resulted in the payment of a fee to the

Company of approximately $18 million, which is included in management fees, franchise fees and other income in

the consolidated statement of income for the year ended December 31, 2007. The Company continues to manage

this hotel subject to the pre-existing management agreement.

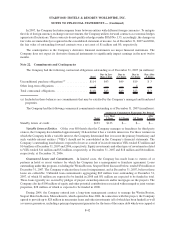

Surety bonds issued on behalf of the Company at December 31, 2007 totaled $99 million, the majority of

which were required by state or local governments relating to our vacation ownership operations and by our insurers

to secure large deductible insurance programs.

To secure management contracts, the Company may provide performance guarantees to third-party owners.

Most of these performance guarantees allow the Company to terminate the contract rather than fund shortfalls if

certain performance levels are not met. In limited cases, the Company is obliged to fund shortfalls in performance

levels through the issuance of loans. At December 31, 2007, excluding the Le Méridien management agreement

mentioned below, the Company had six management contracts with performance guarantees with possible cash

outlays of up to $74 million, $50 million of which, if required, would be funded over several years and would be

largely offset by management fees received under these contracts. Many of the performance tests are multi-year

tests, are tied to the results of a competitive set of hotels, and have exclusions for force majeure and acts of war and

terrorism. The Company does not anticipate any significant funding under these performance guarantees in 2008. In

connection with the acquisition of the Le Méridien brand in November 2005, the Company assumed the obligation

to guarantee certain performance levels at one Le Méridien managed hotel for the periods 2007 through 2013. This

guarantee is uncapped. However, the Company has estimated its exposure under this guarantee and does not

anticipate that payments made under the guarantee will be significant in any single year. The estimated fair present

value of this guarantee of $7 million and $6 million is reflected in other liabilities in the accompanying consolidated

balance sheet at December 31, 2007 and 2006, respectively. The Company does not anticipate losing a significant

number of management or franchise contracts in 2007.

In connection with the purchase of the Le Méridien brand in November 2005, the Company was indemnified

for certain of Le Méridien’s historical liabilities by the entity that bought Le Méridien’s owned and leased hotel

portfolio. The indemnity is limited to the financial resources of that entity. However, at this time, the Company

believes that it is unlikely that it will have to fund any of these liabilities.

In connection with the sale of 33 hotels to Host in 2006, the Company agreed to indemnify Host for certain

liabilities, including operations and tax liabilities. At this time, the Company believes that it will not have to make

any material payments under such indemnities.

Litigation. The Company is involved in various legal matters that have arisen in the normal course of

business, some of which include claims for substantial sums. Accruals have been recorded when the outcome is

probable and can be reasonably estimated. While the ultimate results of claims and litigation cannot be determined,

the Company does not expect that the resolution of all legal matters will have a material adverse effect on its

consolidated results of operations, financial position or cash flow. However, depending on the amount and the

timing, an unfavorable resolution of some or all of these matters could materially affect the Company’s future

results of operations or cash flows in a particular period.

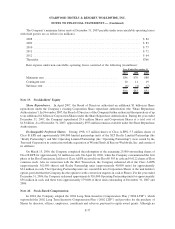

Collective Bargaining Agreements. At December 31, 2007, approximately 33% of the Company’s

U.S.-based employees were covered by various collective bargaining agreements providing, generally, for basic

pay rates, working hours, other conditions of employment and orderly settlement of labor disputes. Generally, labor

F-43

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)