Starwood 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

is not ratified, the Board and the Audit Committee will reconsider the selection of the independent registered public

accounting firm.

The Board unanimously recommends a vote FOR ratification of the appointment of Ernst & Young as the

Company’s independent registered public accounting firm for 2008.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

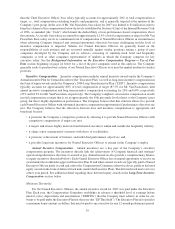

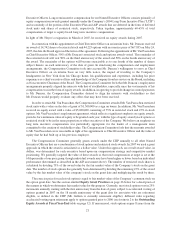

The following tables show the number of Shares “beneficially owned” by (i) all persons known to the

Company to be the beneficial owners of more than 5% of the outstanding Shares at December 31, 2007 and (ii) each

of the Directors, nominees for Director and Named Executive Officers of the Company, and (iii) Directors,

nominees for Director, Named Executive Officers and executive officers (who are not Named Executive Officers) as

a group, at January 31, 2008. “Beneficial ownership” includes Shares a stockholder has the power to vote or the

power to transfer, and also includes stock options and other derivative securities that were exercisable at that date, or

as of that date will become exercisable within 60 days thereafter. In the case of holdings of Directors and executive

officers, percentages are based upon the number of Shares outstanding at January 31, 2008, plus, where applicable,

the number of Shares that the indicated person had a right to acquire within 60 days of such date. The information in

the tables is based upon information provided by each Director and executive officer and, in the case of the

beneficial owners of more than 5% of the outstanding Shares, the information is based upon Schedules 13G and 13D

filed with the SEC.

Certain Beneficial Owners

Name and Address of Beneficial Owner

Amount and Nature of

Beneficial Ownership Percent of Class

Barclays Global Investors, NA ............................... 16,259,550 8.16%(1)

45 Fremont Street

San Francisco, CA 94105

EGI-SSE I, L.P. ......................................... 14,750,000 7.72%(2)

Two North Riverside Plaza, Suite 600

Chicago, IL 60606

FMRLLC.............................................. 13,381,000 6.72%(3)

82 Devonshire St.

Boston, MA 02109

Morgan Stanley .......................................... 11,871,555 6.00%(4)

1585 Broadway

New York, New York 10036

(1) Based on information contained in a Schedule 13G, dated February 6, 2008 (the “Barclays 13G”), filed with

respect to the Company. Barclays Global Investors, NA (“Barclays”) filed the Barclays 13G in its capacity as

investment adviser. The Shares reported are held by Barclays in trust accounts for the economic benefit of the

beneficiaries of those accounts. Barclays, in its capacity as investment advisor, may be deemed to beneficially

own an aggregate amount of 16,259,550 Shares. Barclays is an investment adviser and has sole voting power

over 16,259,550 Shares and sole dispositive power over 14,351,038 Shares.

(2) Based on information contained in a Schedule 13D, dated January 23, 2008 (the “SSE 13D”), filed with respect

to the Company. Between October 2, 2007 and January 31, 2008, EGI-SSE I, L.P. (“SSE”) acquired

14,750,000 Shares in open market purchases in a price range from $39.63 to $62.37 per share. The

average purchase price per share was $49.97, for a total purchase price of $736,997,526.78. The

acquisition of Shares by SSE has been effected solely for the purpose of investment. SSE has no intention

of participating in the formulation, determination or direction of the basic business decisions of the Company or

any affiliate of the Company. SSE has shared voting power and shared dispositive power over

14,750,000 Shares.

11