Starwood 2007 Annual Report Download - page 34

Download and view the complete annual report

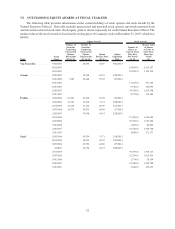

Please find page 34 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.date of grant, or earlier in the event of termination of employment. Stock options provide compensation only

when vested and only if the Company’s stock price appreciates and exceeds the exercise price of the option.

Therefore, during business downturns, option awards may not represent any economic value to an executive.

Restricted stock units and restricted stock provide some measure of mitigation of business cyclicality

while maintaining a direct tie to share price. The Company seeks to enhance the link to stockholder

performance by building a strong retention incentive into the equity program. Consequently, for 2007 grants,

50% of restricted stock units and awards vest on the third anniversary of the date of grant and the remaining

50% vests on the fourth anniversary of the date of grant, subject to accelerated vesting of awards granted in

2007 on the 18 month anniversary of the grant date for associates who are retirement eligible under the LTIP

(Mr. Gellein is currently retirement eligible); different rules regarding accelerated vesting upon retirement

apply to awards granted prior to 2006 (see footnote 3 to the Outstanding Equity Awards at Fiscal Year-End

table on page 32). This delayed vesting places an executive’s long term compensation at risk to share price

performance for a significant portion of the business cycle, while encouraging long-term retention of

executives.

As mentioned above, Named Executive Officers have a mandatory deferral of 25% of their awards under

the Executive Plan in the form of deferred stock units, unless reduced in the discretion of the Compensation

Committee (as done, for example, for Mr. Gellein’s 2007 award in light of his retirement). As such, the awards

combine performance-based compensation with a further link to stockholder interests. First, amounts must be

earned based on annual Company financial and strategic/operational performance under the Executive Plan.

Second, these already earned amounts are put at risk through a vesting schedule. Vesting occurs in installments

for employment over a three year period. Third, these earned amounts become subject to share price

performance. Primarily in consideration of this vesting risk being applied to already earned compensation

(but also taking into account the enhanced stockholder alignment that results from being subject to share

performance), the deferred amount is increased by 33% of value. The Compensation Committee has the

discretion to accelerate vesting or pay out deferred amounts in cash (without interest and without the

percentage increase in value) in a limited number of termination circumstances (e.g., involuntary terminations

or retirements).

Mr. Van Paasschen agreed not to sell any Company stock awards or shares received on exercise of options

(except as may be withheld for taxes) for the first two years of his employment and thereafter only in

consultation with the Board of Directors.

Benefits and Perquisites. Base salary and incentive compensation are supplemented by benefits and

perquisites.

Current Benefits. The Company provides employee benefits that are consistent with local practices and

competitive markets, including group health benefits, life and disability insurance, medical and dependent care

flexible spending accounts and a pre-tax premium payment arrangement. Each of these benefits is provided to

a broad group of employees within the Company and our Named Executive Officers participate in the

arrangements on the same basis as other employees.

Perquisites. As reflected in the Summary Compensation Table below, the Company provides certain

perquisites to select Named Executive Officers when necessary to provide an appropriate compensation

package to those Named Executive Officers, particularly in connection with enabling the executives and their

families to smoothly transition from previous positions which may require relocation.

For example, in 2007 the Company reimbursed Mr. Van Paasschen for $44,556 of legal fees incurred

negotiating his employment agreement with the Company. In addition, Mr. Van Paasschen’s employment

agreement provides that the Company will provide Mr. Van Paasschen with up to a $500,000 credit (based on

the Standard Industry Fare Level formula) for personal use of the Company’s aircraft during the first 12 months

of his employment with the Company. The Company also provided Mr. Van Paasschen with relocation benefits

associated with the sale of his home in Colorado and relocation to the White Plains, New York area.

Mr. Van Paasschen and his immediate family had access to a Company owned or leased airplane on an “as

available” basis for personal travel, i.e., assuming such plane was not needed for business purposes, with an

22