Starwood 2007 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 4. Significant Acquisitions

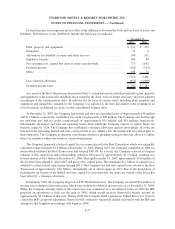

Acquisition of the Sheraton Steamboat Resort and Conference Center

During the second quarter of 2007, the Company purchased the Sheraton Steamboat Resort & Conference

Center for approximately $58 million in cash from a joint venture in which the Company held a 10% interest. The

sale resulted in the recognition of a gain by the joint venture, and the Company’s portion of the gain was

approximately $7 million, which was recorded as a reduction in the basis of the assets purchased by the Company.

Acquisition of interest in a Joint Venture that Purchased the Sheraton Grande Tokyo Bay Hotel

During the first quarter of 2007, the Company entered into a joint venture that acquired the Sheraton Grande

Tokyo Bay Hotel. This hotel has been managed by the Company since its opening and will continue to be operated

by the Company under a long-term management agreement with the joint venture. The Company invested

approximately $19 million in this venture in exchange for a 25.1% ownership interest.

Acquisition of Certain Assets from Club Regina Resorts

In December 2006, the Company completed a transaction to, among other things, purchase certain assets from

Club Regina Resorts (“CRR”) in Mexico. These assets included land and fixed assets adjacent to The Westin

Resort & Spa in Los Cabos, Mexico, and terminated CRR’s rights to solicit guests at three Westin properties in

Mexico. In addition to the purchase of these assets, the transaction included the settlement of all pending and

threatened legal claims between the parties and the exchange of a new issue of CRR notes with a lower principal

amount for notes the Company previously held from an affiliate of CRR. Total consideration of approximately

$41 million was paid by Starwood for these items. The portion related to the legal settlement was expensed.

Development of Restaurant Concepts with Chef Jean-Georges Vongerichten

In May 2006, the Company partnered with Chef Jean-Georges Vongerichten and a private equity firm to create

a joint venture that will develop, own, operate, manage and license world-class restaurant concepts created by

Jean-Georges Vongerichten, including operating the existing Spice Market restaurant located in New York City. The

concepts owned by the venture will be available for Starwood’s upper-upscale and luxury hotel brands including

W, Westin, Le Meridien and St. Regis. Additionally, the venture may own and operate freestanding restaurants

outside of Starwood’s hotels. Starwood invested approximately $22 million in this venture for a 32.7% equity

interest.

Acquisition of Le Méridien

In November 2005, the Company acquired the Le Méridien brand and the related management and franchise

business for the portfolio of 122 hotels and resorts (the “Le Méridien Acquisition”). The purchase price of

approximately $252 million was funded from available cash and the return of funds from the Company’s original

purchase of an interest in Le Méridien debt in late 2003. The Company has accounted for this acquisition under the

purchase method in accordance with SFAS No. 141 and has allocated $114 million of the purchase price to goodwill

with the remainder assigned to the estimated fair value of the assets acquired and liabilities assumed.

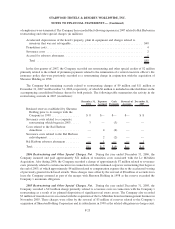

Note 5. Asset Dispositions and Impairments

During 2007, the Company recorded a net loss of $44 million, primarily related to a net loss of $58 million on

the sale of eight wholly owned hotels which were sold in multiple transactions, $20 million of which related to four

hotels that closed in the fourth quarter. These losses were offset in part by $20 million of net gains primarily on the

sale of assets in which we held a minority interest and a gain of $6 million as a result of insurance proceeds received

for property damage caused by storms at two owned hotels in prior years. Other activity resulted in a loss of

$12 million.

F-17

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)