Starwood 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

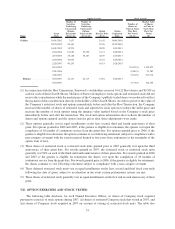

3. Mr. Duncan

In September 2007, with the hiring of Mr. Van Paasschen, Mr. Duncan ceased being Chief Executive Officer on

an interim basis and resumed his position as Non-executive Chairman of the Board. In connection therewith, the

vesting of 50% of Mr. Duncan’s equity grant for serving as Chief Executive Officer was accelerated. The remaining

50% will continue to vest in accordance with its terms, with service as a director counting as continued employment

for purposes of the awards. In addition, because he served as Chief Executive Officer on an interim basis,

Mr. Duncan became entitled to receive at least a pro-rata target bonus for 2007 performance. $960,000 was paid on

March 1, 2008 to satisfy this obligation (with 25% of such amount being deferred into stock units and grossed up by

33% pursuant to the Executive Plan). The bonus amount is reflected in the summary compensation table set forth

above.

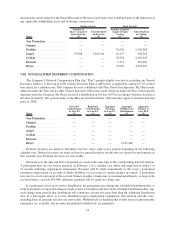

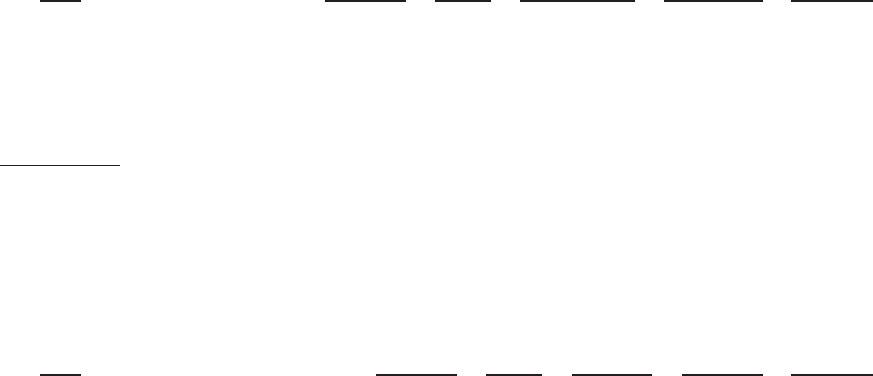

D. Estimated Payments Upon Termination

The tables below reflect the estimated amounts payable to Messrs. Van Paasschen, Ouimet, Siegel, Prabhu and

Gellein in the event their employment with the Company had terminated on December 31, 2007 under various

circumstances, and includes amounts earned through that date. The actual amounts that would become payable in

the event of an actual employment termination can only be determined at the time of such termination.

Given that Messrs. Duncan and Heyer were not employed by the Company as of December 31, 2007 and that

quantitative disclosure of the amounts payable to them in connection therewith has been provided in Section C.

above, the Company has not included in this section quantitative disclosure of the payments that might have been

made to them in the event their employment had terminated on December 31, 2007.

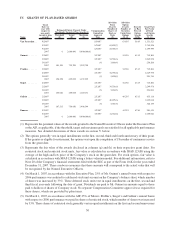

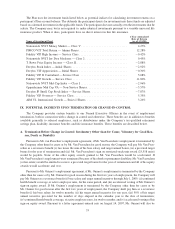

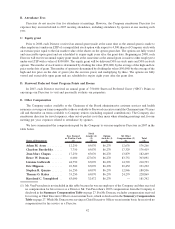

1. Involuntary Termination without Cause or Voluntary Termination for Good Reason

The following table discloses the amounts that would have become payable on account of an involuntary

termination without cause or a voluntary termination for good reason outside of the change in control context.

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted Stock

($)

Vesting of

Stock Options

($)

Total

($)

Van Paasschen ............ 4,749,900 0 1,125,319 0 5,875,219

Ouimet .................. 2,296,418 21,413 1,549,328 0 3,867,159

Siegel(1) ................. 1,200,076 19,699 2,258,695 188,246 3,666,716

Prabhu .................. 625,032 10,260 2,171,296 533,916 3,340,504

Gellein................... 1,500,100 7,451 1,435,730 376,492 3,319,773

(1) Mr. Siegel’s employment agreement provides for payments in the event of involuntary termination other than

for cause but does not provide for payments in the event of voluntary termination for good reason.

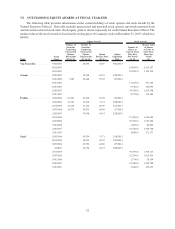

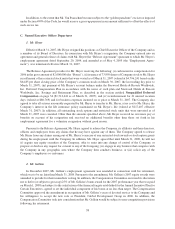

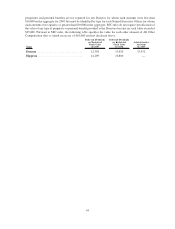

2. Termination on Account of Death or Disability

Name

Severance

Pay

($)

Medical

Benefits

($)

Vesting of

Restricted

Stock

($)

Vesting of

Stock

Options

($)

Total

($)

Van Paasschen ................. 538,000 0 3,938,616 0 4,476,616

Ouimet ....................... 0 0 2,661,966 0 2,661,966

Siegel ........................ 1,200,076 19,699 4,517,390 376,492 6,113,657

Prabhu ....................... 625,032 10,260 4,342,591 1,067,832 6,045,715

Gellein ....................... 750,050 0 1,435,730 376,492 2,562,272

39