Starwood 2007 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

additional awards will be granted under the 2002 LTIP, the Company’s 1999 Long Term Incentive Compensation

Plan or the Company’s 1995 Share Option Plan, the provisions under each of the previous plans will continue to

govern awards that have been granted and remain outstanding under those plans. The aggregate award pool for non-

qualified or incentive stock options, performance shares, restricted stock or any combination of the foregoing which

are available to be granted under the 2004 LTIP at December 31, 2007 was approximately 70 million (with options

counted as one share and restricted stock and performance units counted as 2.8 shares).

Prior to January 1, 2006, the Company accounted for those plans under the recognition and measurement

principles of Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees,” and

related interpretations. In general, no stock-based employee compensation cost related to stock options was

reflected in 2005, as options granted to employees under these plans had an exercise price equal to the fair value of

the underlying common stock on the date of grant. Effective January 1, 2006, the Company adopted the fair value

recognition provisions of SFAS No. 123(R). Under the modified prospective method of adoption selected by the

Company, compensation cost recognized in 2006 is the same as that which would have been recognized had the

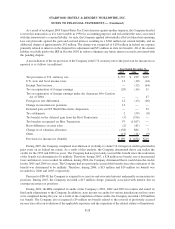

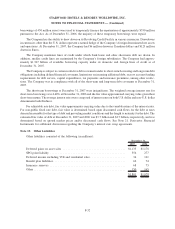

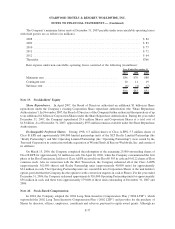

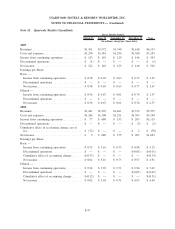

recognition provisions of SFAS No. 123(R) been applied from its original effective date. The following table

illustrates the effect on net income and earnings per Share if the Company had applied the fair value based method to

all outstanding and unvested stock-based employee compensation awards in each period. The Company has

included the estimated impact of reimbursements from third parties.

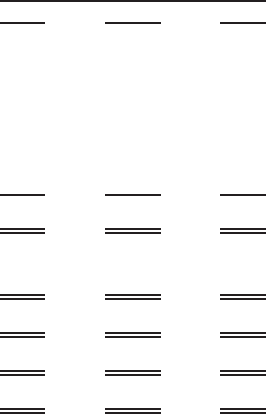

2007 2006 2005

Year Ended December 31,

(In millions, except per Share data)

Net income, as reported ............................ $542 $1,043 $ 422

Add: Stock-based employee compensation expense included

in reported net income, net of related tax effects of $33,

$36and$12................................... 66 67 19

Deduct: SFAS No. 123 compensation cost, net of related tax

effects of $33 $36, and $37 ........................ (66) (67) (69)

Proforma net income .............................. $542 $1,043 $ 372

Earnings per Share:

Basic, as reported ................................. $2.67 $ 4.91 $1.95

Basic, proforma .................................. $2.67 $ 4.91 $1.72

Diluted, as reported ............................... $2.57 $ 4.69 $1.88

Diluted, proforma ................................. $2.57 $ 4.69 $1.65

The Company has determined that a lattice valuation model would provide a better estimate of the fair value of

options granted under its long-term incentive plans than a Black-Scholes model and therefore, for all options

granted subsequent to January 1, 2005, the Company changed its option pricing model from the Black-Scholes

model to a lattice model.

F-38

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)