Starwood 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.April 7, 2006. In December 2006 the Corporation declared a dividend of $0.42 per Corporation Share to

shareholders of record on December 31, 2006, which was paid in January 2007.

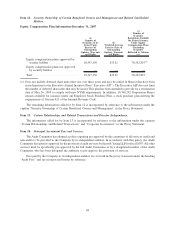

Stock Sales and Repurchases

Share Repurchases. In April of 2007, the Board of Directors authorized an additional $1 billion in Share

repurchases under our existing Corporate Share Repurchase Authorization (the “Share Repurchase Authoriza-

tion”). In November 2007, the Board of Directors of Starwood further authorized the repurchase of up to an

additional $1 billion of Corporation Shares under the Share Repurchase Authorization. During the year ended

December 31, 2007, we repurchased 29.6 million Corporation Shares at a total cost of $1.8 billion. As of

December 31, 2007, approximately $593 million remains available under the Share Repurchase Authorization.

On March 15, 2006 we completed the redemption of the remaining 25,000 shares of Class B EPS for

approximately $1 million in cash. In April 2006, in connection with the Host Transaction, we redeemed all of the

Class A EPS (approximately 562,000 shares) and Realty Partnership units (approximately 40,000 units) for

approximately $34 million in cash. SLC Operating Limited Partnership units are convertible into Shares at the unit

holder’s option, provided that we have the option to settle conversion requests in cash or Shares. In the year ended

December 31, 2007, there were no redemptions. At December 31, 2007, we had outstanding approximately

191 million Corporation Shares and 179,000 SLC Operating Limited Partnership units.

Off-Balance Sheet Arrangements

Our off-balance sheet arrangements include retained interests in securitizations of $40 million, letters of credit

of $133 million, unconditional purchase obligations of $114 million and surety bonds of $99 million. These items

are more fully discussed earlier in this section and in the Notes to Financial Statements and Item 8 of Part II of this

report.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

In limited instances, we seek to reduce earnings and cash flow volatility associated with changes in interest

rates and foreign currency exchange rates by entering into financial arrangements intended to provide a hedge

against a portion of the risks associated with such volatility. We continue to have exposure to such risks to the extent

they are not hedged.

Interest rate swap agreements are the primary instruments used to manage interest rate risk. At December 31,

2007, we had two outstanding long-term interest rate swap agreements under which we pay variable interest rates

and receive fixed interest rates. At December 31, 2007, we had no interest rate swap agreements under which we pay

a fixed rate and receive a variable rate.

We enter into a derivative financial arrangement to the extent it meets the objectives described above, and we

do not engage in such transactions for trading or speculative purposes.

See Note 21. Derivative Financial Instruments in the notes to financial statements filed as part of this Annual

Report and incorporated herein by reference for further description of derivative financial instruments.

40