Starwood 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Compensation Committee considers structural changes to the equity program and the fact that the Compen-

sation Committee targets the median of the peer group for base salary but targets total compensation at the 65%

percentile resulting in larger long term incentive awards. Based on the factors set forth above, including the

Company’s performance and individual performance of each Named Executive Officer, the Compensation

Committee believes that equity award grants in 2007 were appropriate.

Total compensation for this group is evaluated against the peer group identified in this proxy statement.

Evaluated on this basis, the Compensation Committee believes the actual cash and equity compensation

delivered was appropriate in light of the Company’s overall performance and individual executive

performance.

Evaluation Process for Strategic/Operational and Other Goals.

Mr. Heyer. Mr. Heyer resigned his position as Chief Executive Officer effective March 31, 2007. As a

result and pursuant to his separation agreement, Mr. Heyer did not receive any incentive compensation for

2007.

Mr. Duncan. Mr. Duncan served as Chief Executive Officer on an interim basis following Mr. Heyer’s

resignation. Upon Mr. Van Paasschen’s hiring, Mr. Duncan resigned as Chief Executive Officer and resumed

his role as Non-executive Chairman of the Board. Pursuant to his employment agreement, Mr. Duncan is

entitled to a pro-rated target bonus for 2007 because he served as Chief Executive Officer for more than three

months. The Compensation Committee awarded Mr. Duncan the minimum amount permitted under his

employment agreement and did not exercise its discretion to award amounts in excess of the minimum.

Mr. Van Paasschen. Mr. Van Paasschen joined the Company in September 2007. Pursuant to his

employment agreement, Mr. Van Paasschen is entitled to at least a pro-rated target bonus for 2007. The

Compensation Committee awarded Mr. Van Paasschen the minimum amount permitted under his employment

agreement and did not exercise its discretion to award amounts in excess of the minimum.

Other Named Executive Officers. With oversight and input from the Compensation Committee, the

Chief Executive Officer, together with the Chief Administrative Officer, conducts a formal performance

review process each year during which he evaluates how each other Named

Executive Officer performed against the officer’s strategic/operational performance goals for the prior

year. The Chief Executive Officer conducts this evaluation through the Performance Management Process

(“PMP”), which results in a PMP rating for each executive. This PMP rating corresponds to a payout range

under the AIP determined annually by the Compensation Committee for that rating. As noted, for 2007 the

portion of the AIP payouts based on PMP ratings could range from 0% to 175% of target. Where necessary to

preserve the competitive position of the Company’s compensation scale, the Chief Executive Officer may

recommend a market adjustment to the base amount that is subjected to this percentage. At the conclusion of

his review, the Chief Executive Officer submits his recommendations to the Compensation Committee for final

review and approval. In determining the actual award payable to a Named Executive Officer under the

Executive Plan, the Compensation Committee reviews the Chief Executive Officer’s evaluation and makes a

final determination as to how the executive performed against his strategic/operational goals for the year. The

Compensation Committee also determines, based on management’s report, the extent to which the Company’s

financial performance goals were achieved and whether the Company achieved the applicable minimum

threshold(s) required to pay awards. The Chief Executive Officer also meets in executive session with the

Board of Directors to inform the Board of his performance assessments regarding the Named Executive

Officers and the basis for the compensation recommendations he presented to the Compensation Committee.

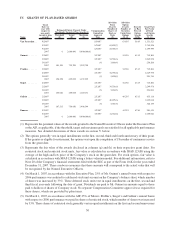

Annual Incentive awards made to our Named Executive Officers under the Executive Plan with respect to

2007 performance are reflected in the Summary Compensation Table on page 27 and described in the

accompanying narrative.

Long-Term Incentive Compensation. Like the annual incentives described above, long-term incentives

are a key part of the Company’s executive compensation program. Long-term incentives are strongly tied to

returns achieved by stockholders, providing a direct link between the interests of stockholders and the Named

20