Starwood 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

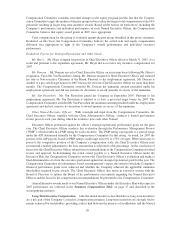

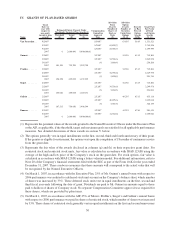

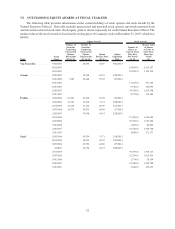

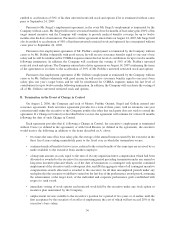

IV. GRANTS OF PLAN-BASED AWARDS

Name

Grant

Date (or

year with

respect to

non-equity

incentive plan

award)

Threshold

($)

Target

($)

Maximum

($)

Compensation

Committee

Approval

Date

All Other

Stock

Awards:

Number of

Shares of

Stock or

Units

(#)

All Other

Option

Awards:

Number of

Securities

Underlying

Options

(#) (2)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Grant Date

Fair Value

of Stock

and Option

Awards

($) (3)

Estimated Future Payouts Under

Non-Equity Incentive Plan Awards(1)

Van Paasschen . . 9/24/07 8/30/07 63,895 58.69 1,331,521

9/24/07 8/30/07 63,895(7) 3,749,998

9/24/07 8/30/07 25,558(7) 1,499,999

2007 0 2,000,000 9,000,000(8)

Ouimet . . . . . . . 2/28/07 2/12/07 34,538 65.15 715,804

2/28/07 2/12/07 34,538(6) 2,249,978

3/01/07 (4) 3,866(4) 250,208

2007 181,300 725,200 1,359,750

Prabhu . . . . . . . 2/28/07 2/12/07 34,538 65.15 715,804

2/28/07 2/12/07 34,538(6) 2,249,978

3/01/07 (5) 3,890(5) 251,761

2007 156,258 625,032 1,171,935

Siegel . . . . . . . . 2/28/07 2/12/07 34,538 65.15 715,804

2/28/07 2/12/07 34,538(6) 2,249,978

3/01/07 (5) 3,462(5) 224,061

2007 150,010 600,038 1,125,071

Gellein . . . . . . . 2/28/07 2/12/07 40,295 65.15 835,118

2/28/07 2/12/07 40,295(6) 2,625,018

3/01/07 (5) 5,071(5) 328,195

2007 187,513 750,050 1,406,344

Duncan. . . . . . . 5/24/07 5/23/07 44,225 67.84 901,434

5/24/07 5/23/07 14,742(6) 1,000,024

2007 0 2,000,000 9,000,000(8)

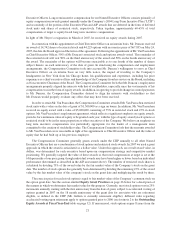

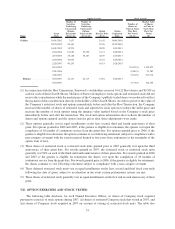

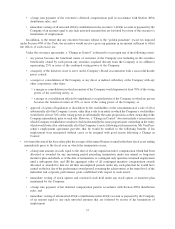

(1) Represents the potential values of the awards granted to the Named Executive Officers under the Executive Plan

or the AIP, as applicable, if the threshold, target and maximum goals are satisfied for all applicable performance

measures. See detailed discussion of these awards in section V. below.

(2) The options generally vest in equal installments on the first, second, third and fourth anniversary of their grant.

If the grantee is eligible for retirement, the options vest upon the completion of 18 months of continuous service

from the grant date.

(3) Represents the fair value of the awards disclosed in columns (g) and (h) on their respective grant dates. For

restricted stock and restricted stock units, fair value is calculated in accordance with SFAS 123(R) using the

average of the high and low price of the Company’s stock on the grant date. For stock options, fair value is

calculated in accordance with SFAS 123(R) using a lattice valuation model. For additional information, refer to

Note 20 of the Company’s financial statements filed with the SEC as part of the Form 10-K for the year ended

December 31, 2007. There can be no assurance that these amounts will correspond to the actual value that will

be recognized by the Named Executive Officers.

(4) On March 1, 2007, in accordance with the Executive Plan, 25% of Mr. Ouimet’s annual bonus with respect to

2006 performance was credited to a deferred stock unit account on the Company’s balance sheet, which number

of shares was increased by 33%. These deferred stock units vest in equal installments on the first, second and

third fiscal year-ends following the date of grant. Dividends are paid to Mr. Ouimet in amounts equal to those

paid to holders of shares of Company stock. No separate Compensation Committee approval was required for

these shares, which are provided by plan terms.

(5) On March 1, 2007, in accordance with the AIP, 25% of Messrs. Prabhu’s, Siegel’s and Gellein’s annual bonus

with respect to 2006 performance was paid in shares of restricted stock, which number of shares was increased

by 33%. These shares of restricted stock generally vest in equal installments on the first and second anniversary

30