Starwood 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174

|

|

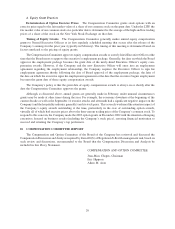

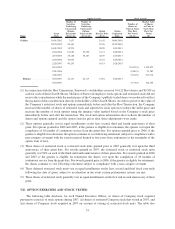

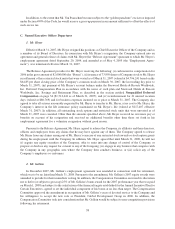

For income tax purposes, Mr. Duncan is a resident of the State of Illinois. The aggregate incremental cost to the

Company for (i) Mr. Duncan’s travel on commercial aircraft, the Company-owned airplane or chartered aircraft

between New York and Chicago, (ii) ground transportation costs and (iii) stays at our hotels in the New York

area was $254,363 in 2007. The value of hotel stays for Mr. Duncan was determined based on the actual

amounts billed to Mr. Duncan and reimbursed by the Company. The net aggregate incremental cost to the

Company of Mr. Van Paasschen’s personal use of the Company-owned plane and chartered aircraft was

$165,606 in 2007. For 2007, also includes relocation benefits which had an aggregate cost of $132,275 and the

reimbursement of $44,556 for legal fees incurred in connection with the negotiation of his employment

agreement. These amounts are included in the All Other Compensation column. The cost of the Company-

owned plane includes the cost of fuel, ground services and landing fees, navigation and telecommunications,

catering and aircraft supplies, crew expenses, aircraft cleaning and an allocable share of maintenance. Pursuant

to SEC rules, the following table specifies the value for each element of All Other Compensation not specified

above other than perquisites and personal benefits that is valued in excess of $10,000.

Name

Rent &

Utilities

($) (2007)

Dividend

Equivalents on

Restricted Stock

($) (2007)

Tax & Financial

Services

($) (2007)

Premiums Paid by

Company for Life

Insurance($)

(2006)

Tax Gross-Up

Payments

($) (2006)

Ouimet .......... 25,992 — — — 126,698

Prabhu .......... — 63,530 — — —

Heyer ........... — 123,807 69,608 142,750 102,858

29