Starwood 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

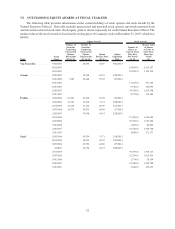

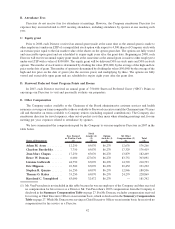

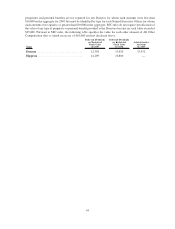

(2) Includes 1,034 Shares granted to each Director, except Mr. Duncan and Mr. Youngblood, in 2007 in two

installments of 199 Shares each and two installments of 318 Shares each. Mr. Youngblood elected to receive

half of his annual fee in cash, and therefore, his amount only includes 516 Shares granted in 2007 in two

installments of 99 Shares each and two installments of 159 Shares each. Mr. Duncan did not receive any director

fees while he was serving as Chief Executive Officer on an interim basis, and therefore, his amount only

includes 543 Shares granted in 2007 in one installment of 199 Shares, one installment of 26 Shares and one

installment of 318 Shares plus restricted stock units granted for serving as Chairman of the Board. As of

December 31, 2007, each Director has the following aggregate number of Shares (deferred or otherwise)

outstanding: Mr. Aron, 11,431; Ambassador Barshefsky, 9,735; Mr. Chapus, 21,869; Mr. Duncan, 183,501;

Ms. Galbreath, 2,675; Mr. Hippeau, 15,677; Mr. Quazzo, 24,876; Mr. Ryder, 10,631; Mr. Youngblood, 5,308.

(3) Represents the expense recognized for financial statement reporting purposes with respect to 2007 for the fair

value of restricted stock and restricted stock units granted in 2007, in accordance with SFAS 123(R). Pursuant to

SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting

conditions. For additional information, refer to Note 20 of the Company’s financial statements filed with the

SEC as part of the Form 10-K for the year ended December 31, 2007. These amounts reflect the Company’s

accounting expense for these awards and do not correspond to the actual value that will be recognized by the

Directors. The grant date fair value of each stock award is set forth below:

Director Grant Date

Number of Shares of

Stock/Units Gant Date Fair Value

All Directors other than Messrs. Duncan

and Youngblood ................... 3/31/2007 199 $12,523

6/30/2007 199 $12,523

9/30/2007 318 $20,012

12/31/2007 318 $20,012

Bruce W. Duncan .................... 3/31/2007 199 $12,523

3/31/2007 596 $37,506

9/30/2007 26 $ 1,636

9/30/2007 50 $ 3,147

12/31/2007 318 $20,012

12/31/2007 596 $37,506

Kneeland Youngblood ................. 3/31/2007 99 $ 6,230

6/30/2007 99 $ 6,230

9/30/2007 159 $10,006

12/31/2007 159 $10,006

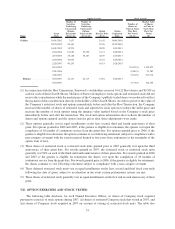

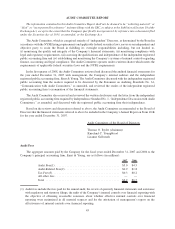

(4) Represents the expense recognized for financial statement reporting purposes with respect to 2007 for the fair

value of stock options granted in 2007, in accordance with SFAS 123(R). Pursuant to SEC rules, the amounts

shown exclude the impact of estimated forfeitures related to service-based vesting conditions. For additional

information, refer to Note 20 of the Company’s financial statements filed with the SEC as part of the Form 10-K

for the year ended December 31, 2007. These amounts reflect the Company’s accounting expense for these

awards and do not correspond to the actual value that will be recognized by the Directors. As of December 31,

2007, each Director has the following aggregate number of stock options outstanding: Mr. Aron, 7,875;

Ambassador Barshefsky, 31,995; Mr. Chapus, 31,995; Mr. Duncan, 48,492; Ms. Galbreath, 15,498;

Mr. Hippeau, 49,651; Mr. Quazzo, 48,492; Mr. Ryder, 37,494; Mr. Youngblood, 37,494. All directors

received a grant of 4,500 options on February 28, 2007 with a grant date fair value of $86,270.

(5) We reimburse directors for travel expenses, other out-of-pocket costs they incur when attending meetings and,

for one meeting per year, attendance by spouses. In addition, in 2007 Directors received 750,000 SPG Points

valued at $11,250 (the Company mistakenly credited Mr. Youngblood’s account with a lesser amount of SPG

Points in 2007, which was corrected with an adjustment in 2008) and the cost of an administrative assistant for

the Chairman of the Board. Directors also receive interest on deferred dividends. Pursuant to SEC rules,

43