Starwood 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

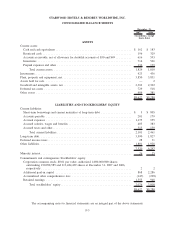

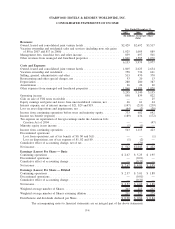

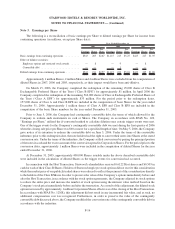

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

CONSOLIDATED STATEMENTS OF EQUITY

Shares Amount Shares Amount Shares Amount

Additional

Paid-in

Capital

(b)

Deferred

Compensation

Accumulated

Other

Comprehensive

Loss

(a)

Retained

Earnings

(Accumulated

Deficit)

Exchangeable

Units and

Class B EPS Class A EPS Shares

(In millions)

Balance at December 31, 2004 . . . ..... — $— 1 $— 209 $4 $5,121 $(14) $(255) $ (68)

Net income . . . ............... — — — — — — — — — 422

Stock option and restricted stock award

transactions, net .............. — — — — 12 — 542 (39) — —

ESPP stock issuances . . .......... — — — — — — 12 — — —

Share repurchases ............... — — — (4) — (253) — — —

Conversion or redemption and

cancellation of Class A EPS, Class B

EPS and Partnership Units . . . ..... — — — — — — (10) — — —

Foreign currency translation . . . ..... — — — — — — — — (60) —

Minimum pension liability adjustment . . — — — — — — — — (6) —

Unrealized loss on securities, net ..... — — — — — — — — (1) —

Distributions declared . . .......... — — — — — — — — — (184)

Balance at December 31, 2005 . . . ..... — — 1 — 217 4 5,412 (53) (322) 170

Net income . . . ............... — — — — — — — — — 1,043

Implementation of SFAS No. 123(R) . . . — — — — — — (53) 53 — —

Disposition of the Trust

(c)

.......... — — — — — — (2,368) — — (83)

Stock option and restricted stock award

transactions, net .............. — — — — 15 — 588 — — —

ESPP stock issuances . . .......... — — — — — — 7 — — —

Share repurchases ............... — — — — (22) — (1,263) — — —

Redemption of convertible debt . ..... — — 3 — — — — —

Conversion or redemption and

cancellation of Class A EPS, Class B

EPS and Partnership Units . . . ..... — — (1) — — (2) (37) — — —

Foreign currency translation . . . ..... — — — — — — — — 72 —

Recognition of accumulated foreign

currency translation adjustments on

sold hotels . . ............... — — — — — — — — 29

Minimum pension liability adjustment . . — — — — — — — — 2 —

Implementation of SFAS No. 158, net . . — — — — — — — — (8)

Unrealized loss on securities, net ..... — — — — — — — — (1) —

Distributions declared . . .......... — — — — — — — — — (182)

Balance at December 31, 2006 . . . ..... — — — — 213 2 2,286 — (228) 948

Net income . . . ............... — — — — — — — — — 542

Stock option and restricted stock award

transactions, net .............. — — — — 7 — 358 — — —

ESPP stock issuances . . .......... — — — — — — 7 — — —

Share repurchases ............... — — — — (29) — (1,787) — — —

Tax adjustments related to the disposition

of the Trust . . ............... — — — — — — 4 — — —

FIN 48 implementation . .......... — — — — — — — — — 35

Foreign currency translation . . . ..... — — — — — — — — 84 —

Unrealized loss on securities, net ..... — — — — — — — — (6) —

Pension adjustments . . . .......... — — — — — — — — 3 —

Distributions declared . . .......... — — — — — — — — — (172)

Balance at December 31, 2007 . . . ..... — $— — $— 191 $2 $ 868 $— $(147) $1,353

(a) As of December 31, 2007, this balance is comprised of $114 million of cumulative translation adjustments and $33 million of cumulative

pension adjustments.

(b) Stock option and restricted stock award transactions are net of a tax benefit of $65 million, $143 million and $66 million in 2007, 2006 and

2005, respectively.

(c) As part of the Host Transaction, the Company sold the Class A Shares of the Trust and shareholders sold the Class B Shares of the Trust. The

book value of the Trust associated with this sale was removed through retained earnings up to the amount of retained earnings that existed at

the sale date with the remaining balance reducing additional paid-in capital. See Note 1 for additional information on the Host Transaction.

The accompanying notes to financial statements are an integral part of the above statements.

F-6