Starwood 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

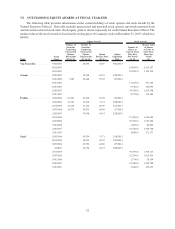

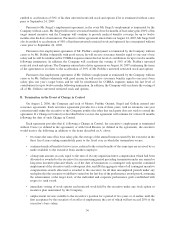

of their grant. Dividends are paid to holders of such restricted stock awards in amounts equal to those paid to

holders of shares of Company stock. No separate Compensation Committee approval was required for these

shares, which are provided by plan terms.

(6) These awards generally vest 50% on each of the third and fourth anniversary of their grant date. If the grantee is

eligible for retirement, the award vests upon the completion of 18 months of continuous service from the grant

date. Mr. Duncan’s restricted stock award provided for accelerated vesting of 50% upon his termination as

Chief Executive Officer on an interim basis with the remaining 50% continuing to vest in accordance with its

terms.

(7) Upon the commencement of Mr. Van Paasschen’s employment with the Company, he received option and

restricted stock awards in accordance with his employment agreement. The options vest in equal installments

on the first, second, third and fourth anniversaries of their grant. The restricted stock will vest 50% on each of

the third and fourth anniversary of the grant date. The restricted stock units vest on the first anniversary of the

date of grant but are not converted into Shares until the third anniversary of the date of grant.

(8) Represents the maximum amount payable to any participant under the terms of the Executive Plan.

V. NARRATIVE DISCLOSURE TO SUMMARY COMPENSATION TABLE AND GRANTS OF

PLAN-BASED AWARDS SECTION

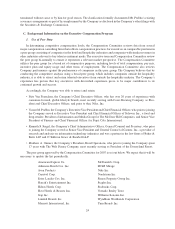

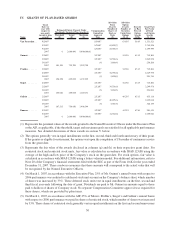

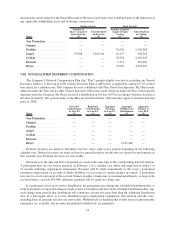

We describe below the Executive Plan awards granted to our Named Executive Officers for 2007. These

awards are reflected in both the Summary Compensation Table on page 27 and the Grants of Plan-Based Awards

table on page 30.

Mr. Van Paasschen and Mr. Duncan each received an incentive award in March 2008 relating to their 2007

performance. Under the terms of their respective employment agreements, Messrs. Van Paasschen and Duncan

were each entitled to receive at least a pro-rata target bonus. The Committee awarded the minimum amount

pursuant to the employment agreement and did not exercise any discretion with respect thereto.

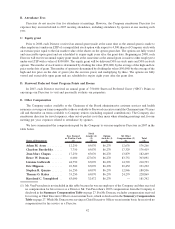

Each of the other Named Executive Officers (other than Mr. Heyer) received an award in March 2008 relating

to his 2007 performance. The table below presents for each such Named Executive Officer his salary, target as both

a percentage of salary and a dollar amount, actual award, the portion of the award that is deferred into restricted

stock units and the 33% increase in this restricted stock units.

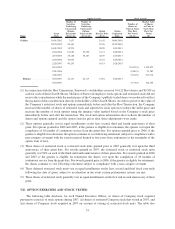

Name

Salary

($)

Award

Target

Relative

to Salary

(%)

Award

Target

($)

Actual

Award

($)

Award Deferred

into Restricted

Stock/Restricted

Stock Units

($)

Increased

Award Deferred

into Restricted

Stock/Restricted

Stock Units

($)

Van Paasschen ......... 1,000,000 200 538,400(1) 538,400 134,600 179,018

Ouimet ............... 725,200 100 725,200 852,110 213,028 283,327

Prabhu ............... 625,032 100 625,032 734,412 183,603 244,192

Siegel ................ 600,038 100 600,038 780,050 195,013 259,367

Gellein ............... 750,050 100 750,050 795,053 — —

Duncan............... 1,000,000 200 2,000,000 960,000 240,000 319,200

(1) Mr. Van Paasschen’s target bonus is $2,000,000. Amount reflected has been adjusted to reflect pro-rata portion

of bonus given Mr. Van Paasschen’s start date with the Company.

The following factors contributed to the Compensation Committee’s determination of the 2007 AIP awards for

these Named Executive Officers:

• the Company’s 2007 financial performance as measured by operating income and earnings per share;

• the 2007 PMP ratings assigned to such executives; and

• the bonuses paid to executive officers performing comparable functions in peer companies.

31