Starwood 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

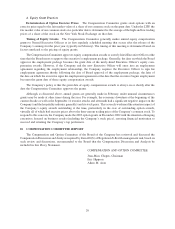

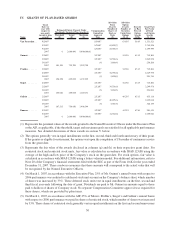

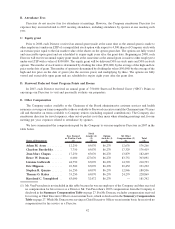

Name

Grant

Date

Number of

Securities

Underlying

Unexercised

Options-

Exercisable

(#) (1) (2)

Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(#) (1) (2)

Option

Exercise Price

($) (1)

Option

Expiration

Date

Number of

Shares or

Units of Stock

That Have

Not Vested

(#) (1)

Market Value

of Shares

or Units of

Stock That

Have Not

Vested

($)

Option Awards Stock Awards

Gellein .............. 10/01/2002 7,637 18.42 10/01/2010

12/23/2002 24,440 20.36 12/23/2010

10/01/2003 15,274 28.99 10/1/2011

2/18/2004 61,650 30,550 31.71 2/18/2012

2/10/2005 38,188 38,187 48.39 2/10/2013

2/23/2006 70,696 52.25 2/23/2014

2/28/2007 40,295 65.15 2/28/2015

2/10/2005 25,457(3) 1,120,872

3/01/2006 2,080(5) 91,582

3/01/2007 5,071(5) 223,276

Duncan ............ 5/24/2007 22,113 22,113 67.84 5/24/2015

5/24/2007 7,371(3) 324,545

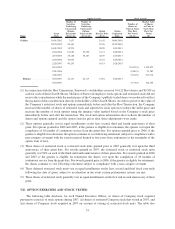

(1) In connection with the Host Transaction, Starwood’s stockholders received 0.6122 Host shares and $0.503 in

cash for each of their Class B Shares. Holders of Starwood employee stock options and restricted stock did not

receive this consideration while the market price of the Company’s publicly traded shares was reduced to reflect

the payment of this consideration directly to the holders of the Class B Shares. In order to preserve the value of

the Company’s restricted stock and options immediately before and after the Host Transaction, the Company

increased the number of shares of restricted stock and adjusted its stock options to reduce the strike price and

increase the number of stock options using the intrinsic value method based on the Company’s stock price

immediately before and after the transaction. The stock and option information above reflects the number of

shares and options granted and the option exercise prices after these adjustments were made.

(2) These options generally vest in equal installments on the first, second, third and fourth anniversary of their

grant. For options granted in 2006 and 2007, if the grantee is eligible for retirement, the options vest upon the

completion of 18 months of continuous service from the grant date. For options granted prior to 2006, if the

grantee is eligible for retirement, the options continue to vest following retirement (subject to compliance with a

non-compete covenant) with the exercise period limited to five years from retirement (or the remainder of the

option term if less).

(3) These shares of restricted stock or restricted stock units granted prior to 2007 generally vest upon the third

anniversary of their grant date. For awards granted in 2007, the restricted stock or restricted stock units

generally vest 50% on each of the third and fourth anniversaries of their grant date. For awards granted in 2006

and 2007, if the grantee is eligible for retirement, the shares vest upon the completion of 18 months of

continuous service from the grant date. For awards granted prior to 2006, if the grantee is eligible for retirement,

the shares continue to vest following retirement subject to compliance with a non-compete covenant.

(4) These deferred restricted stock units vest in equal installments on the first, second and third fiscal year-ends

following the date of grant, subject to acceleration in the event certain performance criteria are met.

(5) These shares of restricted stock generally vest in equal installments on the first and second anniversary of their

grant.

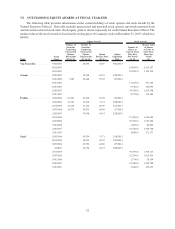

VII. OPTION EXERCISES AND STOCK VESTED

The following table discloses, for each Named Executive Officer, (i) shares of Company stock acquired

pursuant to exercise of stock options during 2007, (ii) shares of restricted Company stock that vested in 2007, and

(iii) shares of Company stock acquired in 2007 on account of vesting of restricted stock units. The table also

33