Starwood 2007 Annual Report Download - page 139

Download and view the complete annual report

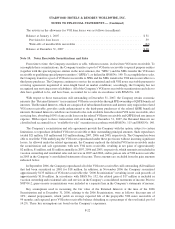

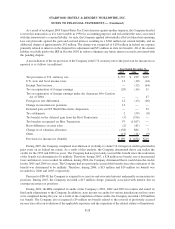

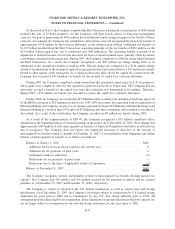

Please find page 139 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.continues to manage the hotel subject to a long-term management contract. Accordingly, the gain on the sale of

approximately $128 million was deferred and is being recognized in earnings over the 10-year life of the

management contract.

The Company sold four additional hotels for approximately $53 million in cash during 2005 and recorded

losses totaling approximately $13 million associated with these sales. The Company had recorded impairment

charges of $17 million in 2004 related to one of these properties.

Also during 2005, the Company sold three hotels unencumbered by long-term management contracts for

approximately $171 million in cash and recorded gains totaling approximately $38 million associated with these

sales.

In August 2005 the Company completed the sale of the St. Regis hotel in Washington D.C. for approximately

$47 million in cash. The Company continues to manage the hotel subject to a long-term management contract.

Accordingly, the gain on the sale of approximately $32 million was deferred and is being recognized in earnings

over the 15-year life of the management contract.

In April 2005, the Company completed the sale of the Sheraton Lisboa Hotel and Towers in Lisbon, Portugal

for approximately $31 million in cash. The Company continues to manage the hotel subject to a long-term

management contract. Accordingly, the gain on the sale of approximately $6 million was deferred and is being

recognized in earnings over the 20-year life of the management contract.

The Company recorded an impairment charge of approximately $17 million in 2005 associated with the

Sheraton Cancun that was demolished to build vacation ownership units. The Company also recorded an

impairment charge of approximately $32 million in accordance with SFAS No. 144 in order to write down one

hotel to its fair market value.

The hotels sold in 2007, 2006 and 2005 were generally encumbered by long-term management or franchise

contracts, and therefore, their operations prior to the sale date are not classified as discontinued operations.

Note 6. Assets Held for Sale

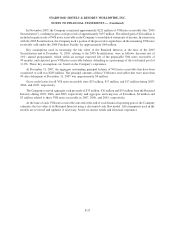

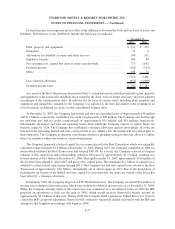

In October 2006, the Company closed on the sale of land near the Montreal Airport to a developer who is

building two Starwood branded hotels on the site. The purchase agreement contains a provision that may allow, but

not obligate, Starwood to repurchase the land for the purchase price it received less a non-refundable amount if the

hotels are not built. As a result of this provision, the Company had not treated this transaction as a sale, and the

Company classified this asset as held for sale at December 31, 2006. As discussed in Note 5, the Company also

recorded an impairment charge of approximately $5 million in 2006 related to this land. During the third quarter of

2007, the hotels reached the stage of development that terminated Starwood’s right to purchase the land in

accordance with the purchase agreement. As such, the sale has now been recognized.

F-19

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)