Starwood 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70,605 for Mr. Duncan; 37,494 for Messrs. Ryder and Youngblood; 31,995 for Ambassador Barshefsky; 16,118

for Mr. Ouimet; 15,498 for Ms. Galbreath and 7,875 for Mr. Aron.

(4) Less than 1%.

(5) Includes 171,954 Shares held by The Bruce W. Duncan Revocable Trust of which Mr. Duncan is a Trustee and

beneficiary.

(6) Includes 24,479 Shares held by a trust of which Mr. Quazzo is settlor and over which he shares investment

control, and 397 Shares owned by Mr. Quazzo’s wife in an Individual Retirement Account.

(7) Includes amounts held by the Named Executive Officers listed on the Summary Compensation Table who were

Named Executive Officers on March 1, 2008.

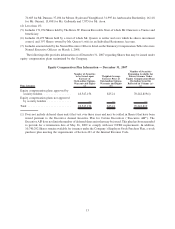

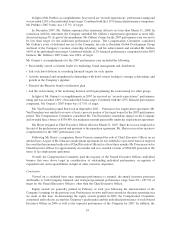

The following table provides information as of December 31, 2007 regarding Shares that may be issued under

equity compensation plans maintained by the Company.

Equity Compensation Plan Information — December 31, 2007

Plan Category

Number of Securities

to be Issued upon

Exercise of

Outstanding Options,

Warrants and Rights

(a)

Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

(b)

Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans

(Excluding Securities

Reflected in Column (a))

(c)

Equity compensation plans approved by

security holders.................. 18,547,156 $25.21 70,242,819(1)

Equity compensation plans not approved

by security holders . . ............. — — —

Total ........................... 18,547,156 $25.21 70,242,819

(1) Does not include deferred share units (that vest over three years and may be settled in Shares) that have been

issued pursuant to the Executive Annual Incentive Plan for Certain Executives (“Executive AIP”). The

Executive AIP does not limit the number of deferred share units that may be issued. This plan has been amended

to provide for a termination date of May 26, 2009 to comply with new NYSE requirements. In addition,

10,740,292 Shares remain available for issuance under the Company’s Employee Stock Purchase Plan, a stock

purchase plan meeting the requirements of Section 423 of the Internal Revenue Code.

13