Starwood 2007 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

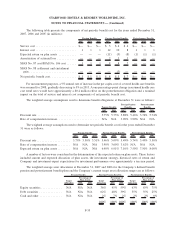

In 2007, the Company had intercompany loans between entities with different foreign currencies. To mitigate

the risk of foreign currency exchange rate movements, the Company utilizes forward contracts as economic hedges

against rate fluctuations. These contracts do not qualify as hedges under SFAS No. 133; accordingly, the changes in

fair value are immediately recognized in the consolidated statement of income. As of December 31, 2007 and 2006,

the fair value of outstanding forward contracts was a net asset of $1 million and $0, respectively.

The counterparties to the Company’s derivative financial instruments are major financial institutions. The

Company does not expect its derivative financial instruments to significantly impact earnings in the next twelve

months.

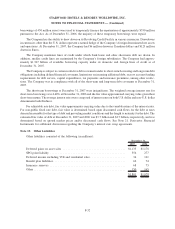

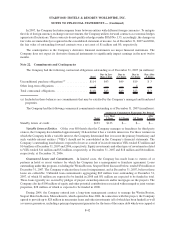

Note 22. Commitments and Contingencies

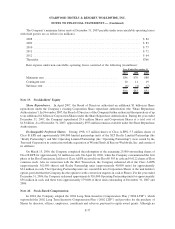

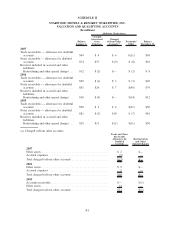

The Company had the following contractual obligations outstanding as of December 31, 2007 (in millions):

Total

Due in Less

than 1 Year

Due in

1-3 Years

Due in

3-5 Years

Due After

5 Years

Unconditional purchase obligations

(a)

............. $114 $43 $49 $19 $ 3

Other long-term obligations .................... 4 — — 4 —

Total contractual obligations .................... $118 $43 $49 $23 $ 3

(a) Included in these balances are commitments that may be satisfied by the Company’s managed and franchised

properties.

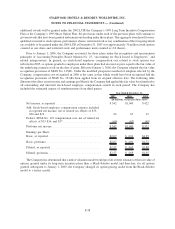

The Company had the following commercial commitments outstanding as of December 31, 2007 (in millions):

Total

Less Than

1 Year 1-3 Years 3-5 Years

After

5 Years

Amount of Commitment Expiration Per Period

Standby letters of credit .......................... $133 $133 $— $— $—

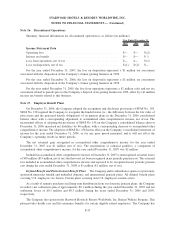

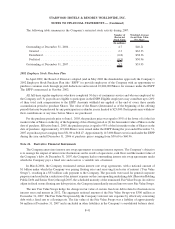

Variable Interest Entities. Of the over 800 hotels that the Company manages or franchises for third party

owners, the Company has identified approximately 26 hotels that it has a variable interest in. For those ventures in

which the Company holds a variable interest, the Company determined that it was not the primary beneficiary and

such variable interest entities (“VIEs”) should not be consolidated in the Company’s financial statements. The

Company’s outstanding loan balances exposed to losses as a result of its involvement in VIEs totaled $7 million and

$14 million at December 31, 2007 and 2006, respectively. Equity investments and other types of investments related

to VIEs totaled $11 million and $52 million, respectively, at December 31, 2007 and $18 million and $64 million,

respectively, at December 31, 2006.

Guaranteed Loans and Commitments. In limited cases, the Company has made loans to owners of or

partners in hotel or resort ventures for which the Company has a management or franchise agreement. Loans

outstanding under this program, excluding the Westin Boston, Seaport Hotel discussed below, totaled $34 million at

December 31, 2007. The Company evaluates these loans for impairment, and at December 31, 2007, believes these

loans are collectible. Unfunded loan commitments aggregating $69 million were outstanding at December 31,

2007, of which $1 million are expected to be funded in 2008 and $51 million are expected to be funded in total.

These loans typically are secured by pledges of project ownership interests and/or mortgages on the projects. The

Company also has $100 million of equity and other potential contributions associated with managed or joint venture

properties, $28 million of which is expected to be funded in 2008.

During 2004, the Company entered into a long-term management contract to manage the Westin Boston,

Seaport Hotel in Boston, Massachusetts, which opened in June 2006. In connection with this project, the Company

agreed to provide up to $28 million in mezzanine loans and other investments (all of which has been funded) as well

as various guarantees, including a principal repayment guarantee for the term of the senior debt which was capped at

F-42

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)