Starwood 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3) Based on information contained in a Schedule 13G/A, dated February 14, 2008 (the “FMR 13G”), filed with

respect to the Company, 11,945,227 Shares are held by Fidelity Management & Research Company

(“Fidelity”), a wholly-owned subsidiary of FMR LLC. (“FMR”); 140,130 Shares are held by Pyramis

Global Advisors, LLC, an indirect wholly-owned subsidiary of FMR; 820,611 Shares are held by Pyramis

Global Advisors Trust Company, an indirect wholly-owned subsidiary of FMR; 397,100 Shares are held by

Fidelity International Limited, a foreign based entity that provides investment advisory and management

services to non-U.S. investment companies (“FIL”) and 77,932 Shares are held by Strategic Advisers, Inc., a

registered investment adviser and wholly owned subsidiary of FMR. According to the FMR Schedule 13G,

FMR and Edward C. Johnson 3rd, Chairman of FMR, each have sole dispositive power and sole voting power

with respect to 820,611 Shares. FIL has sole power to vote and direct the voting of 380,700 Shares, no power to

vote or direct the voting of 16,400 Shares and the sole dispositive power with respect to 397,100 Shares.

Through ownership of voting common stock and the execution of a certain stockholders’ voting agreement,

members of the Edward C. Johnson 3rd family may be deemed, under the Investment Company Act of 1940, to

form a controlling group with respect to FMR.

(4) Based on information contained in a Schedule 13G/A, dated February 14, 2008 (the “Morgan Stanley 13G”),

filed with respect to the Company. Morgan Stanley filed the Morgan Stanley 13G solely in its capacity as the

parent company of, and indirect beneficial owner of securities held by, certain of its operating units. Morgan

Stanley beneficially owns an aggregate amount of 11,871,555 Shares. Morgan Stanley has sole voting power

with respect to 7,977,852 Shares, shared voting over 579 Shares and sole dispositive power over

11,871,555 Shares.

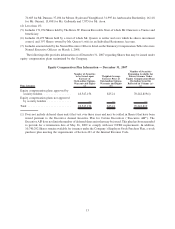

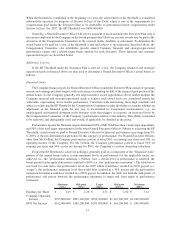

Directors and Executive Officers of the Company

Name of Beneficial Owner

Amount and Nature of

Beneficial Ownership Percent of Class(1)

Adam Aron . . ..................................... 19,306(3) (4)

Charlene Barshefsky ................................ 41,730(2)(3) (4)

Jean-Marc Chapus .................................. 53,864(3) (4)

Bruce W. Duncan .................................. 254,106(2)(3)(5) (4)

Lizanne Galbreath .................................. 18,173(2)(3) (4)

Raymond L. Gellein, Jr. ............................. 386,941(3) (4)

Eric Hippeau . ..................................... 65,328(2)(3) (4)

Matt Ouimet . ..................................... 17,407(3) (4)

Vasant Prabhu ..................................... 323,382(3) (4)

Stephen R. Quazzo ................................. 73,368(3)(6) (4)

Thomas O. Ryder .................................. 48,125(2)(3) (4)

Kenneth S. Siegel .................................. 175,059(3) (4)

Frits Van Paasschen ................................. — (4)

Kneeland C. Youngblood ............................. 42,802(3) (4)

All Directors, Nominees for Directors and executive officers as

a group (14 persons) .............................. 1,519,591(7) (4)

(1) Based on the number of Shares outstanding on January 31, 2008 and Shares issuable upon exercise of options

exercisable within 60 days from January 31, 2008.

(2) Amount includes the following number of “phantom” stock units received as a result of the following Directors’

election to defer Directors’ Annual Fees: 15,677 for Mr. Hippeau; 11,203 for Mr. Duncan; 10,631 for Mr. Ryder;

2,675 for Ms. Galbreath and 1,990 for Ambassador Barshefsky.

(3) Includes Shares subject to presently exercisable options and options and restricted Shares that will become

exercisable or vest within 60 days of January 31, 2008, as follows: 337,897 for Mr. Gellein; 288,605 for

Mr. Prabhu; 117,284 for Mr. Siegel; 48,492 for Mr. Quazzo; 31,995 for Mr. Chapus; 49,651 for Mr. Hippeau;

12