Starwood 2007 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

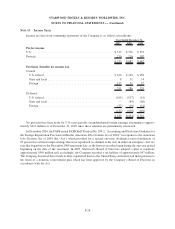

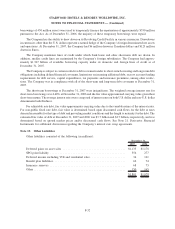

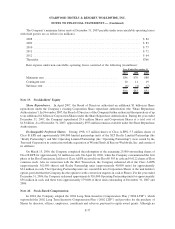

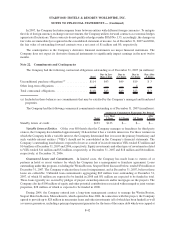

Note 16. Discontinued Operations

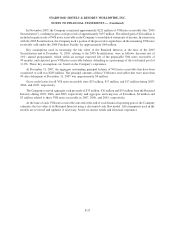

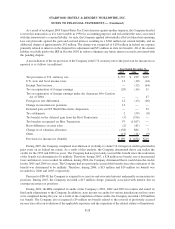

Summary financial information for discontinued operations is as follows (in millions):

2007 2006 2005

Year Ended December 31,

Income Statement Data

Operating loss ............................................. $— $— $(2)

Income tax benefit .......................................... $— $— $ 1

Loss from operations, net of tax ................................ $— $— $(1)

Loss on disposition, net of tax ................................. $(1) $(2) $—

For the year ended December 31, 2007, the loss on disposition represents a $1 million tax assessment

associated with the disposition of the Company’s former gaming business in 1999.

For the year ended December 31, 2006, the loss on disposition represents a $2 million tax assessment

associated with the disposition of the Company’s former gaming business in 1999.

For the year ended December 31, 2005, the loss from operations represents a $2 million sales and use tax

assessment related to periods prior to the Company’s disposal of its gaming business in 1999, offset by a $1 million

income tax benefit related to this business.

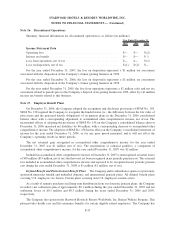

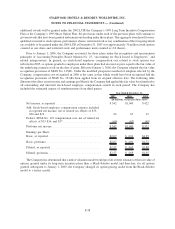

Note 17. Employee Benefit Plans

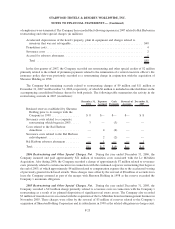

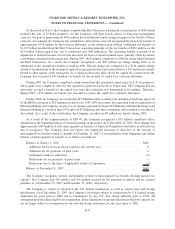

On December 31, 2006, the Company adopted the recognition and disclosure provisions of SFAS No. 158.

SFAS No. 158 required the Company to recognize the funded status (i.e., the difference between the fair value of

plan assets and the projected benefit obligations) of its pension plans in the December 31, 2006 consolidated

balance sheet, with a corresponding adjustment to accumulated other comprehensive income, net of tax. The

incremental effects of adopting the provisions of SFAS No. 158 on the Company’s consolidated balance sheet at

December 31, 2006 increased net liabilities by $6 million, with a corresponding decrease to accumulated other

comprehensive income. The adoption of SFAS No. 158 had no effect on the Company’s consolidated statement of

income for the year ended December 31, 2006, or for any prior period presented, and it will not effect the

Company’s operating results in future periods.

The net actuarial gain recognized in accumulated other comprehensive income for the year ended

December 31, 2007 was $1 million (net of tax). The amortization of actuarial gain/loss, a component of

accumulated other comprehensive income, for the year ended December 31, 2007 was $2 million.

Included in accumulated other comprehensive income at December 31, 2007 is unrecognized actuarial losses

of $43 million ($33 million, net of tax) that have not yet been recognized in net periodic pension cost. The actuarial

loss included in accumulated other comprehensive income and expected to be recognized in net periodic pension

cost during the year ended December 31, 2008 is $1 million ($1 million, net of tax).

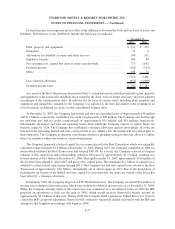

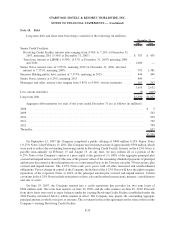

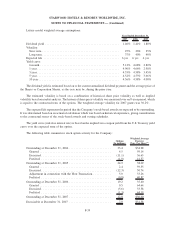

Defined Benefit and Postretirement Benefit Plans. The Company and its subsidiaries sponsor or previously

sponsored numerous funded and unfunded domestic and international pension plans. All defined benefit plans

covering U.S. employees are frozen. Certain plans covering non-U.S. employees remain active.

As a result of annuity purchases and lump sum distributions from our domestic pension plans, the Company

recorded a net settlement gain of approximately $0.1 million during the year ended December 31, 2007 and net

settlement losses of $0.1 million and $0.3 million during the years ended December 31, 2006 and 2005,

respectively.

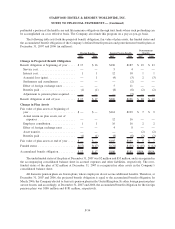

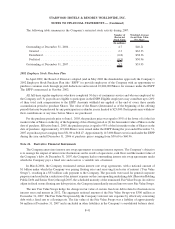

The Company also sponsors the Starwood Hotels & Resorts Worldwide, Inc. Retiree Welfare Program. This

plan provides health care and life insurance benefits for certain eligible retired employees. The Company has

F-33

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)