Starwood 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

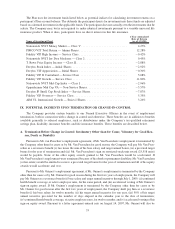

B. Attendance Fees

Directors do not receive fees for attendance at meetings. However, the Company reimburses Directors for

expenses they incurred related to 2007 meeting attendance, including attendance by spouses at one meeting each

year.

C. Equity grant

Prior to 2008, each Director received an annual grant (made at the same time as the annual grant is made to

other employees) under our LTIP of a nonqualified stock option with respect to 4,500 shares of Company stock with

an exercise price equal to the fair market value of the shares on the option grant date. The options are fully vested

and exercisable upon grant and are scheduled to expire eight years after the grant date. Beginning in 2008, each

Director will receive an annual equity grant (made at the same time as the annual grant is made to other employees)

under our LTIP with a value of $100,000. The equity grant will be delivered 50% in stock units and 50% in stock

options. The number of stock units is determined by dividing the value ($50,000) by the average of the high and low

price on the date of grant. The number of options is determined by dividing the value ($50,000) by the average of the

high and low price on the date of grant (also the exercise price) and multiplying by three. The options are fully

vested and exercisable upon grant and are scheduled to expire eight years after the grant date.

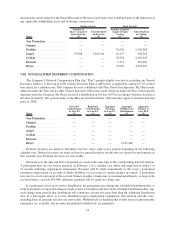

D. Starwood Preferred Guest Program Points and Rooms

In 2007, each Director received an annual grant of 750,000 Starwood Preferred Guest (“SPG”) Points to

encourage our Directors to visit and personally evaluate our properties.

E. Other Compensation

The Company makes available to the Chairman of the Board administrative assistant services and health

insurance coverage on terms comparable to those available to Starwood executives until the Chairman turns 70 years

old and thereafter on terms available to Company retirees (including required contributions). The Company also

reimburses directors for travel expenses, other out-of-pocket costs they incur when attending meetings and, for one

meeting per year, expenses related to attendance by spouses.

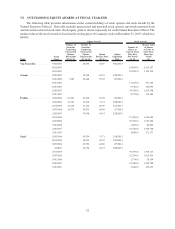

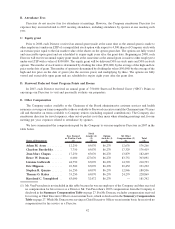

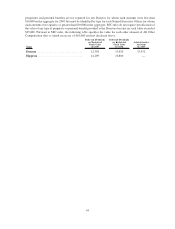

We have summarized the compensation paid by the Company to our non-employee Directors in 2007 in the

table below.

Name of Director(1)

Fees Earned

or Paid in Cash

($)

Stock

Awards (2)

(3)

($)

Option

Awards (4)

($)

All Other

Compensation (5)

($)

Total

($)

Adam M. Aron .......... 12,250 65,070 86,270 12,676 176,266

Charlene Barshefsky ...... 7,750 65,070 86,270 17,329 176,419

Jean-Marc Chapus ....... 17,250 65,070 86,270 13,879 182,469

Bruce W. Duncan ........ 6,000 127,070 86,270 83,751 303,091

Lizanne Galbreath ....... 44,750 65,070 86,270 14,703 210,793

Eric Hippeau............ 10,500 65,070 86,270 29,452 191,292

Stephen R. Quazzo ....... 16,250 65,070 86,270 12,946 180,536

Thomas O. Ryder ........ 53,250 65,070 86,270 24,279 228,869

Kneeland C. Youngblood . . 63,000 32,472 86,270 — 181,742

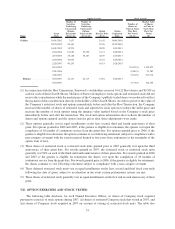

(1) Mr. Van Paasschen is not included in this table because he was an employee of the Company and thus received

no compensation for his services as a Director. Mr. Van Paasschen’s 2007 compensation from the Company is

disclosed in the Summary Compensation Table on page 27. For Mr. Duncan, excludes compensation received

for serving as Chief Executive Officer on an interim basis, which is disclosed in the Summary Compensation

Table on page 27. While Mr. Duncan was serving as Chief Executive Officer on an interim basis, he received no

compensation for his service as a Director.

42