Sears 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

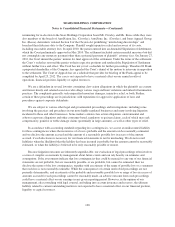

Sears Holdings, through its subsidiaries, engages in commercial transactions with AutoZone, Inc.

(“AutoZone”) in the ordinary course of business. In 2011, we paid AutoZone and its controlled affiliates

approximately $26 million for automotive parts and accessories and $0.6 million for subscription-based auto

repair information. ESL owns 9.7% of the outstanding common stock of AutoZone (based on publicly available

data as of January 23, 2012).

During 2011, ESL and its affiliates purchased unsecured commercial paper issued by Sears Roebuck

Acceptance Corp. (“SRAC”), an indirect wholly owned subsidiary of Sears Holdings. For the commercial paper

outstanding to ESL, the weighted average of each of maturity, annual interest rate, and principal amount

outstanding for this commercial paper in 2011 was 29.2 days, 1.51% and $230 million, respectively. The largest

aggregate amount of principal outstanding to ESL at any time since the beginning of 2011 was $270 million and

the aggregate amount of interest paid by SRAC to ESL during 2011 was $2.6 million. As of January 28, 2012,

ESL held $250 million in principal amount of commercial paper, which includes $130 million held by

Mr. Lampert. The commercial paper purchases were made in the ordinary course of business on substantially the

same terms, including interest rates, as terms prevailing for comparable transactions with other persons, and did

not present features unfavorable to the Company.

In 2011, the Audit Committee approved the purchase from third parties from time to time by Mr. Lampert

and ESL of the Company’s 6 5/8% Senior Secured Notes due 2018 (the “6 5/8% Notes”) and unsecured notes

issued by SRAC and another indirect wholly owned subsidiary of Sears Holdings, Sears DC Corp. (the

“Subsidiary Notes”). In 2011, Mr. Lampert and ESL purchased an aggregate of $95 million of principal amount

of 6 5/8% Notes and $10 million of principal amount of Subsidiary Notes.

On January 26, 2012, ESL entered into an agreement with a financial institution to acquire from the

financial institution an undivided participating interest in a certain percentage of its rights and obligations under

trade receivable put agreements that were entered into with certain vendors of the Company. These agreements

generally provide that, in the event of a bankruptcy filing by the Company, the financial institution will purchase

such vendors’ accounts receivable arising from the sale of goods or services to the Company. ESL may from time

to time choose to purchase an 80% undivided participating interest in the rights and obligations arising under

future trade receivable put agreements that the financial institution enters into with our vendors during the term

of its agreement. The Company is neither a party nor will become a party to any of these agreements. As of

January 28, 2012, ESL held a participation interest totaling $93.3 million in the financial institution’s agreements

relating to the Company.

The Company employs certain employees of ESL. William R. Harker, a Senior Vice President of the

Company, serves as Executive Vice President and General Counsel of ESL and our Senior Vice President of Real

Estate is employed by ESL.

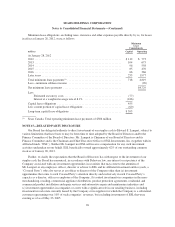

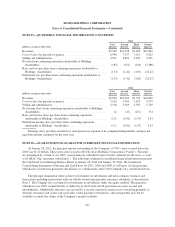

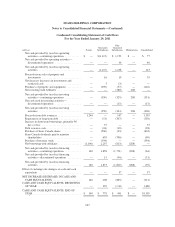

NOTE 16—SUPPLEMENTAL FINANCIAL INFORMATION

Other long-term liabilities at January 28, 2012 and January 29, 2011 consisted of the following:

millions

January 28,

2012

January 29,

2011

Unearned revenues ............................................. $ 778 $ 794

Self-insurance reserves .......................................... 743 753

Other ........................................................ 665 660

Total .................................................... $2,186 $2,207

97