Sears 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We recently announced our plans to separate Sears Hometown and Outlet businesses and certain hardware

stores in the third quarter of 2012 through a transfer to electing shareholders, which is expected to generate in the

range of $400 million to $500 million in proceeds. We also announced that we are in the process of completing a

real estate transaction for 11 stores for $270 million, which is expected to close in April 2012. In addition, Sears

Canada announced that it has entered into an agreement to surrender and early terminate the leases on three

properties for $170 million Canadian in cash proceeds, which is also expected to close in April 2012.

In 2011, we also sharpened our focus to manage our merchandise inventory and payables more closely to

improve our productivity and increase our return on invested capital. We have already made some progress in

reducing our inventory investment as inventory decreased $544 million from the prior year while merchandise

payables have decreased by $134 million. Inventory productivity will continue to be a main focus in 2012 and we

currently plan to realize further reductions in our peak inventory in 2012 in excess of the $500 million to $580

million previously communicated on December 27, 2011. These inventory management initiatives coupled with

the transactions unlocking the value in our assets that were mentioned above are expected to generate over $1

billion in capital in 2012.

We have ongoing discussions concerning our liquidity and financial position with the vendor community

and third parties that offer various credit protection services to our vendors. The topics discussed have included

such areas as pricing, payment terms and ongoing business arrangements. As of the date of this report, we had

not experienced any significant disruption in our access to merchandise or our operations.

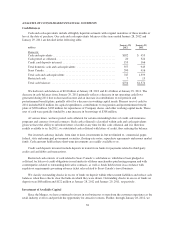

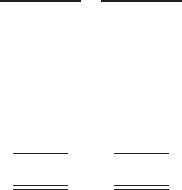

At January 28, 2012, our total debt consisting of short-term borrowings, long-term debt and capital leases

was $3.5 billion, up from $3.2 billion at January 29, 2011. Debt of approximately $340 million related to Orchard

is now presented in current and non-current liabilities of discontinued operations. Taking this into account, our

total debt decreased from the prior year. Our year end 2011 and 2010 outstanding borrowings (excluding

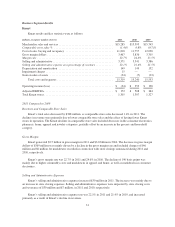

borrowings related to Orchard) were as follows:

millions

January 28,

2012

January 29,

2011

Short-term borrowings:

Unsecured commercial paper ........................................... $ 337 $ 360

Secured borrowings .................................................. 838 —

Long-term debt, including current portion:

Notes and debentures outstanding ....................................... 1,863 2,303

Capitalized lease obligations ........................................... 455 530

Total borrowings ......................................................... $3,493 $3,193

Domestic Credit Agreement

During the first quarter of 2011, we increased the borrowing capacity and extended the maturity date of our

domestic credit agreement (the “Original Domestic Credit Agreement”) by entering into an amended credit

agreement (the “Amended Domestic Credit Agreement”). The Amended Domestic Credit Agreement increased

the borrowing capacity of the facility to $3.275 billion from $2.4 billion and extended its expiration date to April

2016 from June 2012. We view this credit facility as our most cost efficient funding mechanism and therefore

use it as a primary source of funding.

The Amended Domestic Credit Agreement also revised certain terms of the credit facility. Advances

continue to bear interest at a rate equal to, at the election of the Borrowers, either the London Interbank Offered

Rate (“LIBOR”) or a base rate, in either case plus an applicable margin. The amended facility’s interest rates for

LIBOR-based borrowings vary based on leverage in the range of LIBOR plus 2.0% to 2.5%, compared to LIBOR

plus 4.0% with a 1.75% LIBOR floor under the Original Domestic Credit Agreement. Interest rates for base rate-

based borrowings vary based on leverage in the range of the applicable base rate plus 1.0% to 1.5%, compared to

41