Sears 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

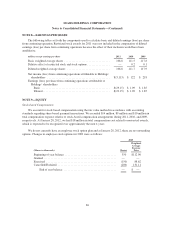

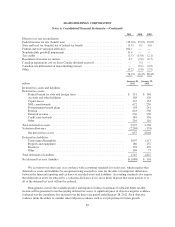

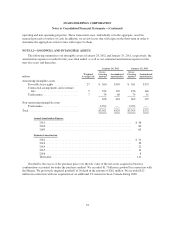

With the exception of the goodwill and fixed asset impairments described above and in Note 13,

respectively, we had no significant remeasurements of such assets or liabilities to fair value during fiscal 2011

and 2010.

All of the fair value remeasurements were based on significant unobservable inputs (Level 3). Fixed asset

fair values were derived based on discussions with real estate brokers, review of comparable properties, if

available, and internal expertise related to the current marketplace conditions. Inputs for the goodwill included

discounted cash flow analyses, comparable marketplace fair value data, as well as management’s assumptions in

valuing significant tangible and intangible assets, as described in Note 1, Summary of Significant Accounting

Policies.

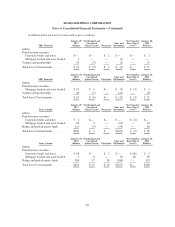

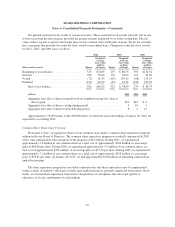

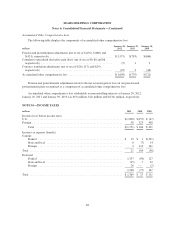

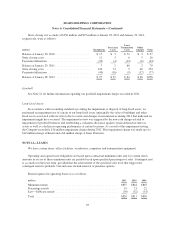

NOTE 13—STORE CLOSING CHARGES, SEVERANCE COSTS AND IMPAIRMENTS

Store Closings and Severance

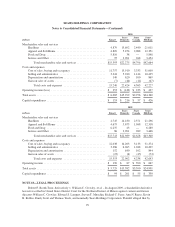

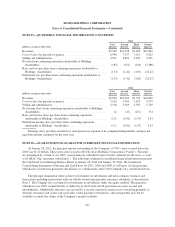

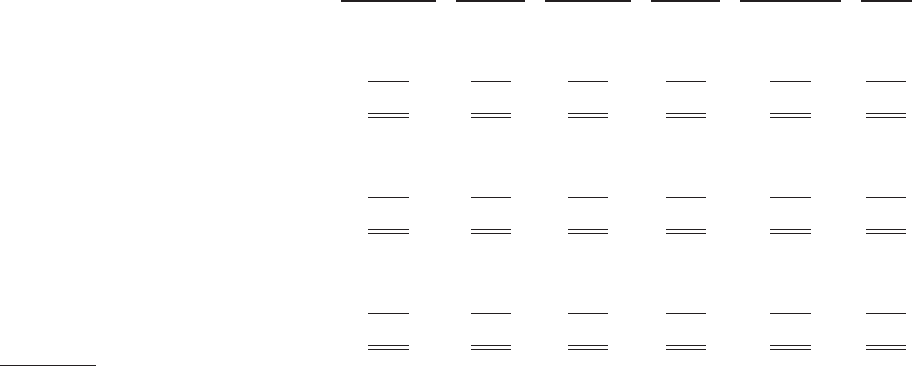

We made the decision to close 74, 11 and 43 stores in our Kmart segment and 173, 15 and 19 stores in our

Sears Domestic segment during 2011, 2010 and 2009, respectively. Within our Sears Domestic segment are the

22 Essentials/Grand stores that have been or will be converted to Kmart stores. Store closing costs recorded

during 2011, 2010 and 2009 were as follows:

millions Markdowns(1)

Severance

Costs(2)

Lease

Termination

Costs(2)

Other

Charges(2)

Impairment

and

Accelerated

Depreciation(3)

Total

Store

Closing

Costs

Kmart .......................... $ 46 $ 14 $ 1 $ 15 $ 5 $ 81

Sears Domestic ................... 84 41 4 31 85 245

Sears Canada ..................... — 18 — — — 18

Total 2011 costs .................. $130 $ 73 $ 5 $ 46 $ 90 $344

Kmart .......................... $ 6 $ 1 $ 4 $ 2 $— $ 13

Sears Domestic ................... 6 2 2 3 10 23

Sears Canada ..................... — — — — — —

Total 2010 costs .................. $ 12 $ 3 $ 6 $ 5 $ 10 $ 36

Kmart .......................... $ 27 $ 13 $ 12 $ 10 $ 3 $ 65

Sears Domestic ................... 10 6 27 6 9 58

Sears Canada ..................... — 8 — — — 8

Total 2009 costs .................. $ 37 $ 27 $ 39 $ 16 $ 12 $131

(1) Recorded within Cost of sales, buying and occupancy on the Consolidated Statements of Operations.

(2) Recorded within Selling and administrative on the Consolidated Statements of Operations.

(3) 2011 costs include $82 million recorded within Impairment charges and $8 million recorded within

Depreciation and amortization on the Consolidated Statements of Operations. 2010 and 2009 costs are

recorded within Depreciation and amortization on the Consolidated Statements of Operations.

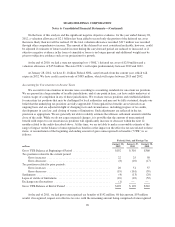

In accordance with accounting standards governing costs associated with exit or disposal activities,

expenses related to future rent payments for which we no longer intend to receive any economic benefit are

accrued for when we cease to use the leased space and have been reduced for any income that we believe can be

realized through sub-leasing the leased space. We expect to record an additional charge of approximately $75

million during the first half of 2012 related to stores we made the decision close in 2011.

94