Sears 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sears Canada Credit Agreement

In September 2010, Sears Canada entered into a five-year, $800 million Canadian senior secured revolving

credit facility (the “Sears Canada Facility”). The Sears Canada Facility is available for Sears Canada’s general

corporate purposes and is secured by a first lien on substantially all of Sears Canada’s non-real estate assets.

Availability under the Sears Canada Facility is determined pursuant to a borrowing base formula based on

inventory and account and credit card receivables, subject to certain limitations. At January 28, 2012, we had

approximately $101 million ($101 million Canadian) of borrowings outstanding under the Sears Canada Facility.

Availability under this agreement, given total outstanding borrowings and letters of credit, was approximately

$415 million ($415 million Canadian) at January 28, 2012.

Letters of Credit Facility

On January 20, 2011, we and certain of our subsidiaries entered into a letter of credit facility (the “LC

Facility”) with Wells Fargo Bank, National Association (“Wells Fargo”), pursuant to which Wells Fargo may, on

a discretionary basis and with no commitment, agree to issue standby letters of credit upon our request in an

aggregate amount not to exceed $500 million for general corporate purposes. Any letters of credit issued under

the LC Facility are secured by a first priority lien on cash placed on deposit at Wells Fargo pursuant to a pledge

and security agreement in an amount equal to 103% of the face value of all issued and outstanding letters of

credit. The LC Facility has a term ending on January 20, 2014, unless terminated sooner pursuant to its terms.

Wells Fargo may, in its sole discretion, terminate the LC Facility at any time. At January 28, 2012, we had no

letters of credit outstanding under the facility. We may replace any letters of credit issued under our LC Facility

with letters of credit issued under the Amended Domestic Credit Agreement and as such, any cash collateral is

considered unrestricted cash.

Debt Repurchase Authorization

In 2005, our Finance Committee of the Board of Directors authorized the repurchase, subject to market

conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or privately

negotiated transactions. Our wholly owned finance subsidiary, Sears Roebuck Acceptance Corp. (“SRAC”), has

repurchased $215 million of its outstanding notes, including $6 million repurchased during 2009. In 2011, Sears

Holdings repurchased $10 million of senior secured notes, recognizing a gain of $2 million. The unused balance

of this authorization is $275 million.

Unsecured Commercial Paper

We borrow through the commercial paper markets. At January 28, 2012 and January 29, 2011, we had

outstanding commercial paper borrowings of $337 million and $360 million, respectively. ESL Investments, Inc.

held $250 million and $240 million at January 28, 2012 and January 29, 2011, respectively. See Note 15 for

further discussion of these borrowings.

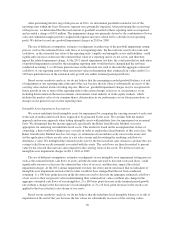

Debt Ratings

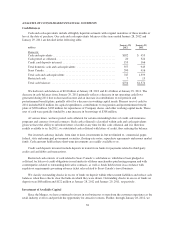

Our corporate family debt ratings at January 28, 2012 appear in the table below:

Moody’s

Investors

Service

Standard &

Poor’s

Ratings

Services

Fitch

Ratings

B3 CCC+ CCC

43