Sears 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

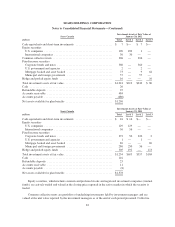

Notes to Consolidated Financial Statements—(Continued)

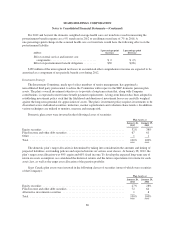

Sears Canada Hedges of Merchandise Purchases

Sears Canada had no outstanding foreign currency collar contracts at January 28, 2012. Sears Canada had

entered into foreign currency collar contracts with a total notional value of $372 million at January 29, 2011. As

discussed previously, these collar contracts are used to hedge Sears Canada’s purchase of inventory under U.S.

dollar denominated contracts. We record mark-to-market adjustments based on the total notional value of these

outstanding collar contracts at the end of each period. We recorded mark-to-market liabilities related to the

foreign currency collar contracts of $3 million at January 29, 2011.

We record the earnings impact of mark-to-market and settlement adjustments for foreign currency collar

contracts in other loss at the end of each period. We recorded mark-to-market and settlement gains on these

contracts of $4 million in other loss for the year ended January 28, 2012 and mark-to-market and settlement

losses on these contracts of $14 million in other loss for the year ended January 29, 2011.

Sears Canada’s above noted foreign currency collar contracts were entered into as a hedge of merchandise

purchase contracts denominated in U.S. currency. We also record mark-to-market adjustments for the value of

the merchandise purchase contracts (considered to be embedded derivatives under relevant accounting rules) at

the end of each period. We recorded assets of $1 million at January 28, 2012 and $2 million at January 29, 2011

related to the fair value of these embedded derivatives.

We record the earnings impact of mark-to-market and settlement adjustments related to the embedded

derivative in the merchandise purchase contracts in other loss at the end of each period. We recorded net

mark-to-market and settlement losses of $5 million for the year ended January 28, 2012 and $1 million for the

year ended January 29, 2011.

At January 28, 2012, we had total mark-to-market assets related to the collar contracts and embedded

derivatives of $1 million. We recorded total net mark-to-market losses and settlements of $1 million in other loss

for the year ended January 28, 2012. At January 29, 2011, we had total derivative mark-to-market liabilities

related to the collar contracts and embedded derivatives of $1 million. We recorded total net mark-to-market

losses and settlements of $15 million in other loss for the year ended January 29, 2011. See Note 5 for further

information regarding fair value of these collar and merchandise purchase contracts and the respective balance

sheet classifications at January 28, 2012 and January 29, 2011.

Hedges of Net Investment in Sears Canada

At January 28, 2012 and January 29, 2011, we had a foreign currency forward contract outstanding with a

Canadian notional value of $629 million, and with a weighted-average remaining life of 0.1 years at January 28,

2012 and 0.5 years at January 29, 2011. These contracts were designated and qualified as hedges of the foreign

currency exposure of our net investment in Sears Canada. Accordingly, the aggregate fair value of the forward

contract outstanding at January 28, 2012 of approximately $(6) million was recorded as a liability on our

Consolidated Balance Sheet and the fair value of the forward contract outstanding at January 29, 2011 of

approximately $1 million was recorded as an asset on our Consolidated Balance Sheet. The decline in fair value

of approximately $7 million related to these forward contracts, net of tax, was recorded as a component of other

comprehensive loss for the year ended January 28, 2012.

We settled foreign currency forward contracts during 2010 and paid a net amount of $3 million relative to

these contract settlements. As hedge accounting was applied to such contracts, an offsetting amount was recorded

as a component of other comprehensive loss.

73