Sears 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

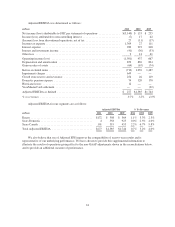

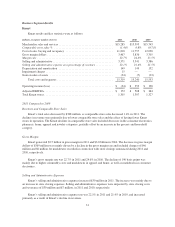

Holdings’ Consolidated Results

Holdings’ consolidated results of operations for 2011, 2010 and 2009 are summarized as follows:

millions, except per share data 2011 2010 2009

REVENUES

Merchandise sales and services ........................................ $41,567 $42,664 $43,360

COSTS AND EXPENSES

Cost of sales, buying and occupancy .................................... 30,966 31,000 31,374

Gross margin dollars ................................................ 10,601 11,664 11,986

Margin rate ....................................................... 25.5% 27.3% 27.6%

Selling and administrative ............................................ 10,664 10,425 10,499

Selling and administrative expense as a percentage of revenues .............. 25.7% 24.4% 24.2%

Depreciation and amortization ......................................... 853 869 894

Impairment charges ................................................. 649 — —

Gain on sales of assets ............................................... (64) (67) (74)

Total costs and expenses ......................................... 43,068 42,227 42,693

Operating income (loss) .............................................. (1,501) 437 667

Interest expense .................................................... (289) (293) (248)

Interest and investment income ........................................ 41 36 33

Other loss ......................................................... (2) (14) (61)

Income (loss) from continuing operations before income taxes ............... (1,751) 166 391

Income tax expense ................................................. (1,369) (27) (111)

Income (loss) from continuing operations ................................ (3,120) 139 280

Income (loss) from discontinued operations, net of tax ...................... (27) 11 17

Net income (loss) ................................................... (3,147) 150 297

(Income) loss attributable to noncontrolling interests ....................... 7 (17) (62)

NET INCOME (LOSS) ATTRIBUTABLE TO HOLDINGS’

SHAREHOLDERS ............................................... $(3,140) $ 133 $ 235

Amounts attributable to Holdings’ shareholders:

Income (loss) from continuing operations, net of tax ....................... $(3,113) $ 122 $ 218

Income (loss) from discontinued operations, net of tax ...................... (27) 11 17

Net income (loss) ................................................... $(3,140) $ 133 $ 235

NET INCOME (LOSS) PER COMMON SHARE ATTRIBUTABLE TO

HOLDINGS’ SHAREHOLDERS

Diluted:

Continuing operations ............................................... $(29.15) $ 1.09 $ 1.85

Discontinued operations .............................................. (0.25) 0.10 0.14

$ (29.40) $ 1.19 $ 1.99

Diluted weighted average common shares outstanding ...................... 106.8 111.7 117.9

References to comparable store sales amounts within the following discussion include sales for all stores

operating for a period of at least 12 full months, including remodeled and expanded stores, but excluding store

relocations and stores that have undergone format changes. Comparable store sales results for 2011 were

calculated based on the 52-week period ended January 28, 2012.

Beginning with the first quarter of 2011, we now include in comparable store sales online sales from

sears.com and kmart.com shipped directly to customers. These online sales increased 16% for 2011 compared to

22