Sears 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

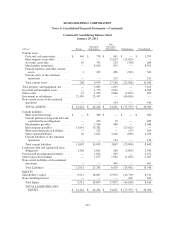

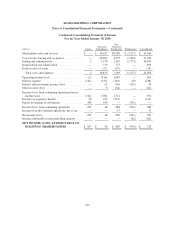

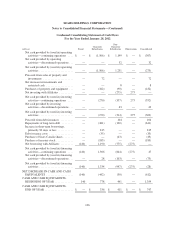

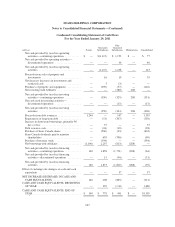

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

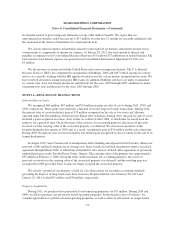

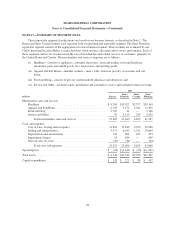

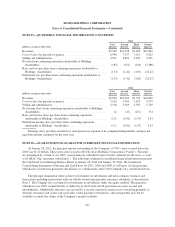

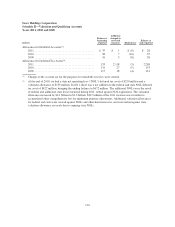

NOTE 19—QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

2011

millions, except per share data

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Revenues .................................................. $9,540 $10,138 $9,405 $12,484

Cost of sales, buying and occupancy ............................ 6,996 7,537 7,011 9,422

Selling and administrative ..................................... 2,507 2,601 2,635 2,921

Net loss from continuing operations attributable to Holdings’

shareholders .............................................. (165) (152) (410) (2,386)

Basic net loss per share from continuing operations attributable to

Holdings’ shareholders ..................................... (1.53) (1.42) (3.85) (22.47)

Diluted net loss per share from continuing operations attributable to

Holdings’ shareholders ..................................... (1.53) (1.42) (3.85) (22.47)

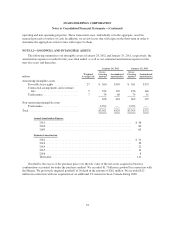

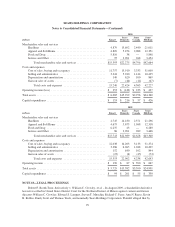

2010

millions, except per share data

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Revenues .................................................. $9,876 $10,263 $9,523 $13,002

Cost of sales, buying and occupancy ............................ 7,103 7,503 7,015 9,379

Selling and administrative ..................................... 2,516 2,569 2,591 2,749

Net income (loss) from continuing operations attributable to Holdings’

shareholders .............................................. 12 (47) (217) 374

Basic net income (loss) per share from continuing operations

attributable to Holdings’ shareholders ......................... 0.11 (0.42) (1.97) 3.43

Diluted net income (loss) per share from continuing operations

attributable to Holdings’ shareholders ......................... 0.11 (0.42) (1.97) 3.43

Earnings (loss) per share amounts for each quarter are required to be computed independently and may not

equal the amount computed for the total year.

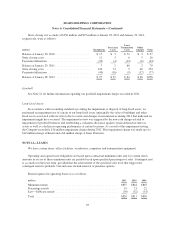

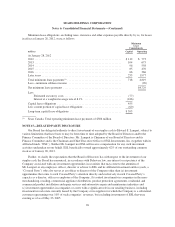

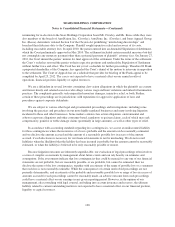

NOTE 20—GUARANTOR/NON-GUARANTOR SUBSIDIARY FINANCIAL INFORMATION

At January 28, 2012, the principal amount outstanding of the Company’s 6 5/8% senior secured notes due

2018 was $1.24 billion. These notes were issued in 2010 by Sears Holdings Corporation (“Parent”). The notes

are guaranteed by certain of our 100% owned domestic subsidiaries that own the collateral for the notes, as well

as by SRAC (the “guarantor subsidiaries”). The following condensed consolidated financial information presents

the Condensed Consolidating Balance Sheets at January 28, 2012 and January 29, 2011, the Condensed

Consolidating Statements of Income and Cash Flows for 2011, 2010 and 2009 of (i) Parent; (ii) the guarantor

subsidiaries; (iii) the non-guarantor subsidiaries; (iv) eliminations and (v) the Company on a consolidated basis.

The principal elimination entries relate to investments in subsidiaries and inter-company balances and

transactions including transactions with our wholly-owned non-guarantor insurance subsidiary as described in

Note 3. The Company has accounted for investments in subsidiaries under the equity method. The guarantor

subsidiaries are 100% owned directly or indirectly by the Parent and all guarantees are joint, several and

unconditional. Additionally, the notes are secured by a security interest in certain assets consisting primarily of

domestic inventory and credit card receivables of the guarantor subsidiaries, and consequently may not be

available to satisfy the claims of the Company’s general creditors.

101