Sears 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

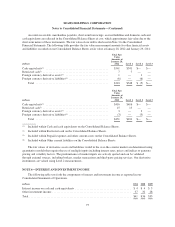

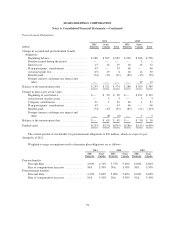

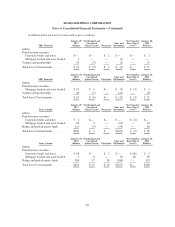

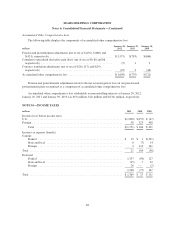

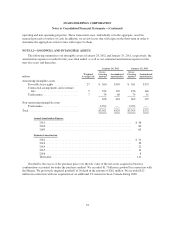

Fair Value of Pension and Postretirement Benefit Plan Assets

Level 1 cash equivalents and other short-term investments, common and preferred stock, pooled equity

funds and fixed income securities are valued using a market approach based on quoted market prices of identical

instruments. Level 2 cash equivalents and short-term investments are valued daily by the fund using a market

approach with inputs that include quoted market prices for similar instruments. Level 2 fixed income securities

are valued at the net asset value provided by the fund administrator and have daily or monthly liquidity. The

following table presents our plan assets using the fair value hierarchy at January 28, 2012 and January 29, 2011:

SHC Domestic

Investment Assets at Fair Value at

January 28, 2012

millions Total Level 1 Level 2 Level 3

Cash equivalents and short-term investments ......................... $ 216 $ — $ 216 $—

Equity securities

U.S. companies ............................................... 1,102 1,102 — —

International companies ........................................ 120 120 — —

Registered investment companies ................................ 1 1 — —

Fixed income securities

Corporate bonds and notes ...................................... 2,186 — 2,184 2

Sears Holdings Corporation senior secured notes .................... 203 — 203 —

U.S. government and agencies ................................... 39 — 39 —

Mortgage backed and asset backed ............................... 9 — 9 —

Municipal and foreign government ............................... 20 — 20 —

Ventures and partnerships ........................................ 15 — — 15

Total investment assets at fair value ................................ $3,911 $1,223 $2,671 $ 17

Cash ......................................................... 111

Accounts receivable ............................................. 54

Accounts payable ............................................... (25)

Net assets available for plan benefits ................................ $4,051

SHC Domestic

Investment Assets at Fair Value at

January 29, 2011

millions Total Level 1 Level 2 Level 3

Cash equivalents and short-term investments ......................... $ 248 $ — $ 248 $—

Equity securities

U.S. companies ............................................... 1,231 1,231 — —

International companies ........................................ 185 185 — —

Registered investment companies ................................ 1 1 — —

Fixed income securities

Corporate bonds and notes ...................................... 1,952 — 1,952 —

Sears Holdings Corporation senior secured notes .................... 240 — 240 —

U.S. government and agencies ................................... 15 — 15 —

Mortgage backed and asset backed ............................... 32 — 31 1

Municipal and foreign government ............................... 58 — 58 —

Ventures and partnerships ........................................ 21 — 1 20

Total investment assets at fair value ................................ $3,983 $1,417 $2,545 $ 21

Cash ......................................................... 60

Accounts receivable ............................................. 47

Accounts payable ............................................... (36)

Net assets available for plan benefits ................................ $4,054

82