Sears 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

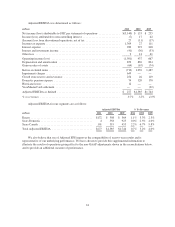

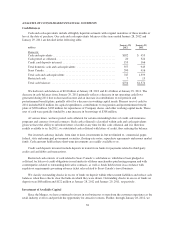

Business Segment Results

Kmart

Kmart results and key statistics were as follows:

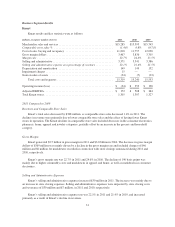

millions, except for number of stores 2011 2010 2009

Merchandise sales and services ...................................... $15,285 $15,593 $15,743

Comparable store sales % ......................................... (1.4)% 0.8% (0.7)%

Cost of sales, buying and occupancy ................................. 11,818 11,757 12,038

Gross margin dollars .............................................. 3,467 3,836 3,705

Margin rate ..................................................... 22.7% 24.6% 23.5%

Selling and administrative .......................................... 3,371 3,341 3,386

Selling and administrative expense as a percentage of revenues ............ 22.1% 21.4% 21.5%

Depreciation and amortization ...................................... 149 149 152

Impairment charges ............................................... 15 — —

Gain on sales of assets ............................................ (34) (7) (23)

Total costs and expenses ....................................... 15,319 15,240 15,553

Operating income (loss) ........................................... $ (34) $ 353 $ 190

Adjusted EBITDA ................................................ $ 172 $ 508 $ 364

Total Kmart stores ................................................ 1,305 1,307 1,327

2011 Compared to 2010

Revenues and Comparable Store Sales

Kmart’s total sales decreased by $308 million, as comparable store sales decreased 1.4% in 2011. The

declines in revenue were primarily due to lower comparable store sales and the effect of having fewer Kmart

stores in operation. The Kmart declines in comparable store sales included decreases in the consumer electronics,

pharmacy, home, apparel and jewelry categories, partially offset by an increase in the grocery and household

category.

Gross Margin

Kmart generated $3.5 billion in gross margin in 2011 and $3.8 billion in 2010. The decrease in gross margin

dollars of $369 million was mainly driven by a decline in the gross margin rate and included charges of $46

million and $6 million for markdowns recorded in connection with store closings announced during 2011 and

2010, respectively.

Kmart’s gross margin rate was 22.7% in 2011 and 24.6% in 2010. The decline of 190 basis points was

mainly due to higher commodity costs and markdowns in apparel and home, as well as markdowns in consumer

electronics.

Selling and Administrative Expenses

Kmart’s selling and administrative expenses increased $30 million in 2011. The increase was mainly due to

an increase in store closing expenses. Selling and administrative expenses were impacted by store closing costs

and severance of $30 million and $7 million, in 2011 and 2010, respectively.

Kmart’s selling and administrative expense rate was 22.1% in 2011 and 21.4% in 2010, and increased

primarily as a result of Kmart’s decline in revenues.

31