Sears 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gross Margin

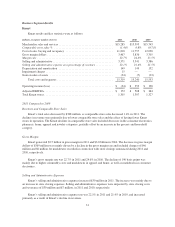

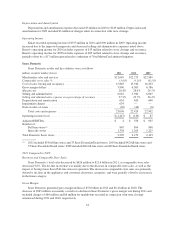

Sears Domestic’s gross margin dollars declined $421 million to $6.4 billion in 2010. Gross margin in 2010

included a $6 million charge recorded in cost of sales for margin related expenses taken in connection with store

closings. Sears Domestic’s gross margin for 2009 included a $10 million charge for markdowns recorded in

connection with store closings. The decline was mainly a result of the impact of lower overall sales on Sears

Domestic’s gross margin and a decline in margin rate. Sears Domestic’s gross margin rate was 28.6% in 2010

and 29.5% in 2009, a decrease of 90 basis points. The decline was mainly due to reduced margin rates in home

services and appliances.

Selling and Administrative Expenses

Sears Domestic’s selling and administrative expenses decreased $125 million to $5.9 billion in 2010 and

included incremental expenses of $102 million related to our continued investment in our multi-channel

capabilities and the continued launch of our Shop Your Way Rewards program. The decrease includes a reduction

in payroll and benefits expense of $80 million, a reduction in advertising expenses of $35 million, and a $42

million reduction in insurance expense, as well as reductions in various other expense categories. Selling and

administrative expenses for 2010 were impacted by domestic pension plan expense of $120 million and store

closing costs and severance of $7 million. Selling and administrative expenses for 2009 were impacted by

domestic pension plan expense of $170 million, store closing costs and severance of $39 million, and a $15

million gain related to settlement of Visa/MasterCard antitrust litigation.

Our selling and administrative expense rate was 26.7% for 2010 and 26.4% for 2009. The increase in our

selling and administrative expense rate is primarily the result lower expense leverage given lower overall sales.

Depreciation and Amortization

Depreciation and amortization expense decreased by $20 million to $620 million during 2010, and included

charges of $10 million and $9 million in 2010 and 2009, respectively, taken in connection with store closings.

The decrease is primarily attributable to having fewer assets available for depreciation.

Gain on Sales of Assets

We recorded a gain on the sales of assets of $46 million during 2010 and $6 million in 2009. We sold a

Sears Auto Center in October 2006, at which time we leased back the property for a period of time. Given the

terms of the contract, for accounting purposes, the excess of proceeds received over the carrying value of the

associated property was deferred. We closed our operations at this location during the first quarter of 2010 and,

as a result, recognized a gain of $35 million on this sale at that time.

Operating Income (Loss)

Sears Domestic reported an operating loss of $149 million in 2010 and operating income of $87 million in

2009. The decrease in Sears Domestic’s operating results was primarily the result of lower gross margin dollars

given lower overall sales and lower margin rate, partially offset by reductions in selling and administrative

expenses and the above noted significant items. Operating income in 2010 included expenses of $143 million

related to domestic pension plans and store closings and severance, as well as a gain of $35 million recognized

on the sale of a Sears Auto Center. Operating income in 2009 included expenses of $228 million related to

domestic pension plans and store closings and severance, as well as a $15 million gain related to settlement of

Visa/MasterCard antitrust litigation.

35