Sears 2011 Annual Report Download - page 20

Download and view the complete annual report

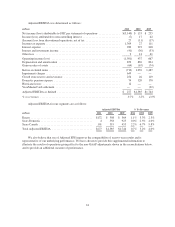

Please find page 20 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

We have divided our “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” into the following six sections:

• Overview of Holdings

• Results of Operations:

Fiscal Year

Holdings’ Consolidated Results

Business Segment Results

• Analysis of Consolidated Financial Condition

• Contractual Obligations and Off-Balance Sheet Arrangements

• Application of Critical Accounting Policies and Estimates

• Cautionary Statement Regarding Forward-Looking Information

The discussion that follows should be read in conjunction with the consolidated financial statements and

notes thereto included in Item 8.

OVERVIEW OF HOLDINGS

Holdings is the parent company of Kmart and Sears. We are a broadline retailer and, at the end of 2011, had

2,172 Kmart and domestic full-line stores and 1,338 specialty retail stores in the United States operating through

Kmart and Sears and 500 full-line and specialty retail stores in Canada operating through Sears Canada, a

95%-owned subsidiary. We plan to close 173 stores and change the format of 8 stores in the first half of 2012.

We currently conduct our operations in three reportable business segments: Kmart, Sears Domestic and

Sears Canada. The nature of operations conducted within each of these segments is discussed within the

“Business Segments” section of Item 1 in this report on Form 10-K. Our business segments have been

determined in accordance with accounting standards regarding the determination, and reporting, of business

segments.

The retail industry is highly competitive and as such, Holdings faces significant challenges, including the

current macroeconomic environment, as many of our product categories are impacted by the housing market and

availability of credit to our customers. The retail industry is also rapidly evolving as retail is increasingly

impacted by new technologies and social media. We believe that this evolution provides us with significant

growth opportunities, if we are able to transform our portfolio of businesses by leveraging our existing store

network with emerging technologies and our Shop Your Way Rewards program to develop lasting relationships

with our customers.

We consider ourselves to be an asset-rich enterprise with multiple resources at our disposal. At year end, we

had $3.2 billion in liquidity and significant value in our asset portfolio, including valuable iconic proprietary

brands, a valuable real estate portfolio, well- known stand-alone businesses and a flexible financial structure. We

are taking actions to address our operating performance in three areas:

• First, we are implementing immediate actions which we believe will improve our financial

performance, including cost and inventory reductions, closure of marginally performing stores, actions

to improve margins, and bringing in talent to strengthen the leadership team. We have reduced

inventory by $544 million below last year’s level and our promotional cadence has been adjusted to be

more targeted.

20