Sears 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

to recover our deferred tax assets within the jurisdiction from which they arise, we consider all available positive

and negative evidence, including scheduled reversals of deferred tax liabilities, projected future taxable income,

tax planning strategies, and results of recent operations. In projecting future taxable income, we begin with

historical results adjusted for the results of discontinued operations and changes in accounting policies and

incorporate assumptions including the amount of future state, federal and foreign pre-tax operating income, the

reversal of temporary differences, and the implementation of feasible and prudent tax planning strategies. In

evaluating the objective evidence that historical results provide, we consider cumulative operating income (loss)

over the past three years. These assumptions require significant judgment about the forecasts of future taxable

income.

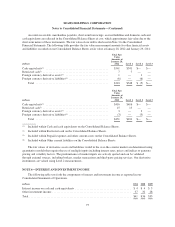

Stock-based Compensation

We account for stock-based compensation arrangements in accordance with accounting standards pertaining

to share-based payment transactions, which requires us to both recognize as expense the fair value of all stock-

based compensation awards (which includes stock options, although there were no options outstanding in 2011)

and to classify excess tax benefits associated with share-based compensation deductions as cash from financing

activities rather than cash from operating activities. We recognize compensation expense as awards vest on a

straight-line basis over the requisite service period of the award.

Earnings Per Common Share

Basic earnings per common share is calculated by dividing net income attributable to Holdings’

shareholders by the weighted average number of common shares outstanding for each period. Diluted earnings

per common share also includes the dilutive effect of potential common shares, exercise of stock options and the

effect of restricted stock when dilutive.

New Accounting Pronouncements

Testing Goodwill for Impairment

In September 2011, the Financial Accounting Standards Board (“FASB”) issued an accounting standards

update which provides, subject to certain conditions, the option to perform a qualitative, rather than quantitative,

assessment to determine whether it is more likely than not that the fair value of a reporting unit is less than its

carrying amount. The update will be effective for us in the first quarter of 2012, but early adoption is permitted.

The update may reduce the complexity and costs of testing goodwill for impairment, but otherwise is not

expected to have a material impact on our consolidated financial position, annual results of operations or cash

flows.

Presentation of Comprehensive Income

In June 2011, the FASB issued an accounting standards update which revises the manner in which entities

present comprehensive income in their financial statements. The new guidance removes the presentation options

in existing guidance and requires entities to report components of comprehensive income in either (1) a

continuous statement of comprehensive income or (2) two separate but consecutive statements. Under the

two-statement approach, the first statement would include components of net income, which is consistent with

the income statement format used today, and the second statement would include components of other

comprehensive income (“OCI”). The update does not change the items that must be reported in OCI and its

amendments are effective for fiscal years, and interim periods within those years, beginning after December 15,

2011. The guidance must be applied retrospectively for all periods presented in the financial statements. Early

66