Sears 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We sold a Sears Auto Center in October 2006, at which time we leased back the property for a period of

time. Given the terms of the contract, for accounting purposes, the excess of proceeds received over the carrying

value of the associated property was deferred. We closed our operations at this location during the first quarter of

2010 and, as a result, recognized a gain of $35 million on this sale at that time.

Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario in August 2007.

Sears Canada leased back the property under a leaseback agreement through March 2009, at which time it

finished its relocation of all head office operations to previously underutilized space in the Toronto Eaton Centre,

Ontario. Given the terms of the leaseback, for accounting purposes, the excess of proceeds received over the

carrying value of the associated property was deferred, and the resulting $44 million gain was recognized when

Sears Canada no longer occupied the associated property in 2009.

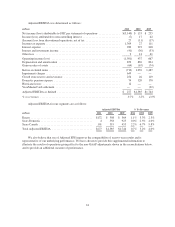

Operating Income

Operating income was $437 million for 2010 and $667 million for 2009. Operating income decreased $230

million and was the result of reductions in gross margin, partially offset by lower selling and administrative

expenses. Operating income for 2010 included expenses of $156 million related to domestic pension plans, store

closings and severance and a $35 million gain recognized on the sale of a Sears Auto Center. Operating income

for 2009 included expenses of $301 million related to domestic pension plans, store closings and severance, a

$44 million gain recognized by Sears Canada on the sale of its former headquarters, and a $32 million gain

recorded in connection with the settlement of Visa/MasterCard antitrust litigation.

Interest Expense

We incurred $293 million in interest expense during 2010 and $248 million in 2009. Our interest expense

increased primarily due to an increase in average total debt balances throughout 2010.

Other Loss

Other loss is primarily comprised of mark-to-market and settlement gains and losses on Sears Canada hedge

transactions. Total net mark-to-market and settlement losses of $15 million were recorded on these transactions

in 2010. Total net mark-to-market and settlement losses of $67 million were recorded on these transactions in

2009. See Notes 4 and 5 of Notes to Consolidated Financial Statements for further information regarding these

transactions.

Income Taxes

Our effective tax rate was 16.3% in 2010 and 28.4% in 2009. The decrease in our tax rate is primarily due to

lower taxable income and the resolution of certain federal and state income tax matters during 2010, which

resulted in a $13 million tax benefit.

30