Sears 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

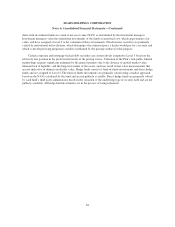

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

Interest Income on Cash and Cash Equivalents

We recorded interest income of $4 million in both 2011 and 2010, and $5 million in 2009, primarily related

to interest earned on cash and cash equivalents. These cash and cash equivalents consist of highly liquid

investments with original maturities of three months or less at the date of purchase. Our invested cash may

include, from time to time, investments in, but not limited to, commercial paper, federal, state and municipal

government securities, floating-rate notes, repurchase agreements and money market funds. All invested cash

amounts are readily available to us.

Other Investment Income

Other investment income primarily includes income generated by (and sales of investments in) certain real

estate joint ventures and other equity investments in which we do not have a controlling interest. Investment

income from equity investments was $27 million, $17 million and $11 million in 2011, 2010 and 2009,

respectively. Other investment income also included a $4 million, $6 million and $9 million dividend received on

our cost method investment in Sears Mexico for 2011, 2010 and 2009, respectively.

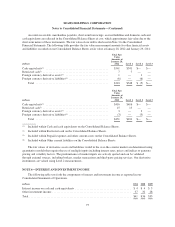

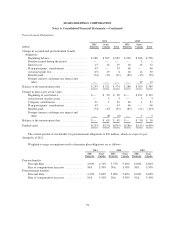

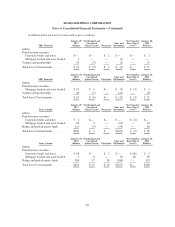

NOTE 7—BENEFIT PLANS

We sponsor a number of pension and postretirement benefit plans. Expenses for retirement and savings-

related benefit plans were as follows:

millions 2011 2010 2009

Retirement/401(k) Savings Plans ................................... $ 11 $ 11 $ 13

Pension plans ................................................... 78 119 172

Postretirement benefits ........................................... 24 27 27

Total ......................................................... $113 $157 $212

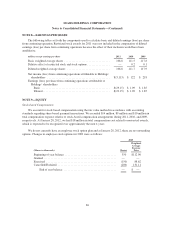

Retirement Savings Plans

We sponsor Sears and Kmart 401(k) retirement savings plans for employees meeting service eligibility

requirements. Prior to 2009, we matched a portion of employee contributions made to the plans. The Company

announced during 2008 that it would suspend matching contributions on employee deferrals to 401(k) plans with

respect to eligible compensation earned for payroll periods that end after January 30, 2009.

Effective July 1, 2008, the Sears Canada defined pension plan was amended and a defined contribution

component was added. The defined benefit service accrual ceased and all plan members earn pensionable service

under the defined contribution component of the Sears Registered Retirement Plan.

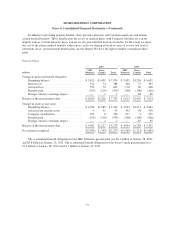

Domestic Benefit Plans

Certain domestic full-time and part-time employees of Sears are eligible to participate in noncontributory

defined benefit plans after meeting age and service requirements. Substantially all full-time Canadian employees,

as well as some part-time employees, are eligible to participate in contributory defined benefit plans. Pension

benefits are based on length of service, compensation and, in certain plans, social security or other benefits.

Funding for the various plans is determined using various actuarial cost methods. Effective January 1, 2006, the

Sears domestic pension plan was frozen and domestic associates no longer earn additional benefits under the

plan.

76