Sears 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

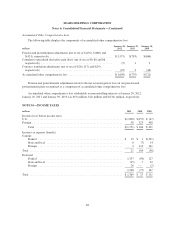

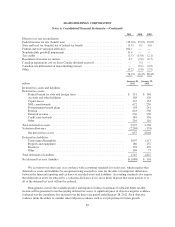

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

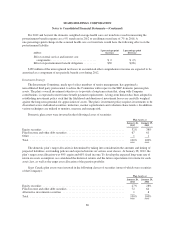

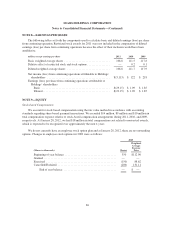

The Sears Canada plans’ target allocation is determined by taking into consideration the amounts and timing

of projected liabilities, our funding policies and expected returns on various asset classes. At January 28, 2012,

the plan’s target asset allocation was 55% to 75% fixed income and 25% to 45% equity. To develop the expected

long-term rate of return on assets assumption, we considered the historical returns and the future expectations for

returns for each asset class, as well as the target asset allocation of the pension portfolio.

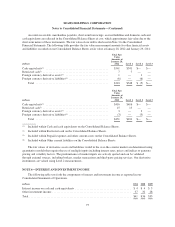

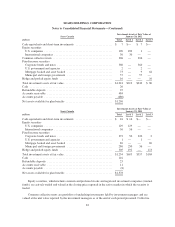

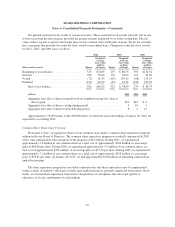

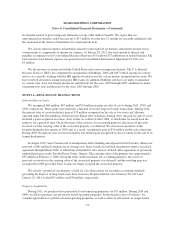

Future Cash Flows of Benefit Plans

Information regarding expected future cash flows for our benefit plans is as follows:

millions

SHC

Domestic

Sears

Canada Total

Pension benefits:

Employer contributions:

2012 (expected) .............................................. $ 314 $ 34 $ 348

Expected benefit payments:

2012 ........................................................... $ 351 $ 94 $ 445

2013 ........................................................... 359 93 452

2014 ........................................................... 368 93 461

2015 ........................................................... 378 93 471

2016 ........................................................... 388 93 481

2017-2021 ...................................................... 2,034 465 2,499

Postretirement benefits:

Employer contributions:

2012 (expected) .............................................. $ 30 $ 1 $ 31

Expected employer contribution for benefit payments:

2012 ........................................................... $ 30 $ 18 $ 48

2013 ........................................................... 28 18 46

2014 ........................................................... 27 19 46

2015 ........................................................... 25 19 44

2016 ........................................................... 24 19 43

2017-2021 ...................................................... 96 98 194

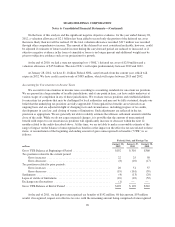

Domestic Pension Plan Funding

Contributions to our pension plans remain a significant use of our cash on an annual basis. While Sears

Holdings’ pension plan is frozen, and thus associates do not currently earn pension benefits, the company has a

legacy pension obligation for past service performed by Kmart and Sears, Roebuck and Co. associates. During

2011, we contributed $352 million to our domestic pension plans. We estimate that the domestic pension

contribution will be $314 million in 2012 and approximately $740 million in 2013, though the ultimate amount

of pension contributions could be affected by changes in the applicable regulations as well as financial market

and investment performance.

81