Sears 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

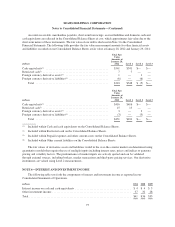

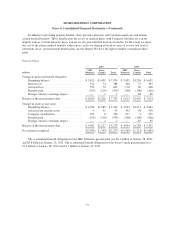

At January 28, 2012, long-term debt maturities for the next five years and thereafter were as follows:

millions

2012 .............................................................. $ 230

2013 .............................................................. 70

2014 .............................................................. 54

2015 .............................................................. 150

2016 .............................................................. 40

Thereafter .......................................................... 1,774

$2,318

Interest

Interest expense for years 2011, 2010 and 2009 was as follows:

millions 2011 2010 2009

COMPONENTS OF INTEREST EXPENSE

Interest expense ................................................. $248 $242 $203

Accretion of lease obligations at net present value ...................... 20 21 22

Amortization of debt issuance costs ................................. 21 30 23

Interest expense ................................................. $289 $293 $248

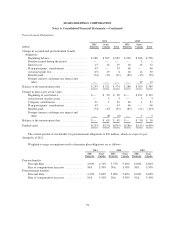

Debt Repurchase Authorization

In 2005, our Finance Committee of the Board of Directors authorized the repurchase, subject to market

conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or privately

negotiated transactions. Our wholly owned finance subsidiary, Sears Roebuck Acceptance Corp. (“SRAC”), has

repurchased $215 million of its outstanding notes, including $6 million repurchased during 2009. In 2011, Sears

Holdings repurchased $10 million of senior secured notes, recognizing a gain of $2 million. The unused balance

of this authorization is $275 million.

Unsecured Commercial Paper

We borrow through the commercial paper markets. At January 28, 2012 and January 29, 2011, we had

outstanding commercial paper borrowings of $337 million and $360 million, respectively. ESL Investments, Inc.

held $250 million and $240 million at January 28, 2012 and January 29, 2011, respectively. See Note 15 for

further discussion of these borrowings.

Domestic Credit Agreement

During the first quarter of 2011, we increased the borrowing capacity and extended the maturity date of our

domestic credit agreement (the “Original Domestic Credit Agreement”) by entering into an amended credit

agreement (the “Amended Domestic Credit Agreement”). The Amended Domestic Credit Agreement increased

the borrowing capacity of the facility to $3.275 billion from $2.4 billion and extended its expiration date to April

2016 from June 2012. We view this credit facility as our most cost efficient funding mechanism and therefore

use it as a primary source of funding.

69