Sears 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Second, we are executing actions intended to unlock the value of our portfolio, such as our recently

announced real estate transactions that are expected to generate approximately $440 million ($270

million for Sears Domestic and $170 million Canadian for Sears Canada) in cash proceeds upon their

closing, which are expected to occur in our first quarter, as well as our announcement of plans to

separate the Hometown and Outlet businesses and certain hardware stores through a transfer to electing

shareholders to purchase an interest in these businesses. The Hometown and Outlet businesses and

certain hardware stores combined assets represent approximately $2.3 billion to $2.6 billion in SHC

revenue and between $70 million and $80 million in SHC EBITDA with $350 million to $400 million

in SHC net assets and $325 million to $375 million in SHC net inventory (net of merchandise

payables).

• Third, we are accelerating actions intended to drive our strategic agenda to become the leader in

Integrated Retail. Profound changes in technology are changing the entire retail landscape, the ways

customers shop and the way they live. Americans spend as much time today on the internet as they do

watching TV, and more time today on their mobile devices than they do with print media. Customers

are more connected and empowered than ever before. We are accelerating our actions to bring together

a unique set of technology and retail assets to deliver a seamless, integrated experience for our Shop

Your Way Rewards members and customers—at the store, online, and in the home. At the core of our

strategy we are building a deeply engaging membership program, called Shop Your Way Rewards.

We’re building technologies and a platform that we expect will allow us to have continuous

relationships with our customers.

• We launched our Shop Your Way Rewards program late in 2009 and continued to grow membership

and capabilities in 2011. The Shop Your Way Rewards program is intended to transition Sears Holdings

from serving customers to building relationships with members. We believe that Shop Your Way

Rewards will allow us to learn more about our individual customers and therefore position us to better

meet their needs. The Shop Your Way Rewards program will also enhance our ability to communicate

with customers digitally. Such digital communication tools present a new opportunity to personalize

our messages and make them more individually relevant. What the future holds for Sears Holdings is a

progressive re-shaping and deepening of our relationships with our members. Given the size of our

membership today and the breadth of our assortment, this is very compelling for our business model.

• In 2011, we invested several hundred million dollars in our customer experience across touch points.

We believe that our investments will deliver compelling benefits to our members, several of which are

already in the market, like return and exchanges of online purchases in 5 minutes or less; no receipt

required; great deals personalized to consumers’ interests; and assistance by associates with innovative

technology applications and devices to help find the right appliance or TV or tractor to fit our

customers’ needs.

• We will continue to invest in our online properties. By integrating our vast store network with our

online properties, we believe that Sears Holdings will succeed in the rapidly evolving retail

environment. The web and mobile platforms integrate shopping and marketing in a very different way

than stores and traditional media have in the past.

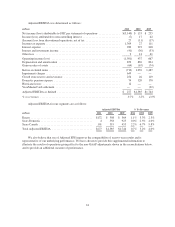

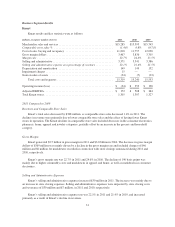

RESULTS OF OPERATIONS

Fiscal Year

Our fiscal year end is the Saturday closest to January 31 each year. Fiscal years 2011, 2010 and 2009 all

consisted of 52 weeks. Unless otherwise stated, references to years in this report relate to fiscal years rather than

to calendar years. The following fiscal periods are presented in this report.

Fiscal year Ended Weeks

2011 .............................................. January 28, 2012 52

2010 .............................................. January 29, 2011 52

2009 .............................................. January 30, 2010 52

21