Sears 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

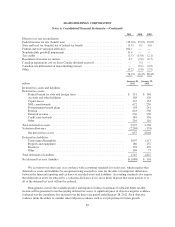

Notes to Consolidated Financial Statements—(Continued)

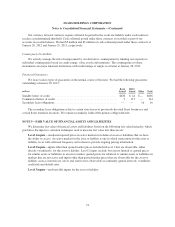

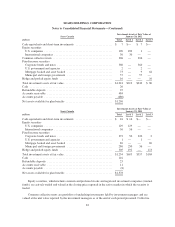

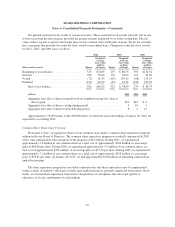

short-term investment funds are stated at net asset value (NAV) as determined by the investment managers.

Investment managers value the underlying investments of the funds at amortized cost, which approximates fair

value, and have assigned a Level 2 to the valuation of those investments. Fixed income securities are primarily

valued by institutional bid evaluation, which determines the estimated price a dealer would pay for a security and

which is developed using proprietary models established by the pricing vendors for this purpose.

Certain corporate and mortgage-backed debt securities are conservatively assigned to Level 3 based on the

relatively low position in the preferred hierarchy of the pricing source. Valuation of the Plan’s non-public limited

partnerships requires significant judgment by the general partners due to the absence of quoted market value,

inherent lack of liquidity, and the long-term nature of the assets, and may result in fair value measurements that

are not indicative of ultimate realizable value. Hedge funds consist of fund-of-funds investments and direct hedge

funds and are assigned to Level 3. The fund-of-funds investments are primarily valued using a market approach

based on the NAVs calculated by the fund and are not publicly available. Direct hedge funds are primarily valued

by each fund’s third party administrator based on the valuation of the underlying type of security held and are not

publicly available. All hedge fund investments are in the process of being redeemed.

84