Sears 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

be due and payable immediately. Generally, the Company is required to offer to repurchase all outstanding Notes

at a purchase price equal to 101% of the principal amount if the borrowing base (as calculated pursuant to the

indenture) falls below the principal value of the notes plus any other indebtedness for borrowed money that is

secured by liens on the Collateral for two consecutive quarters or upon the occurrence of certain change of

control triggering events. The Company may call the Notes at a premium based on the “Treasury Rate” as

defined in the indenture, plus 50 basis points. On September 6, 2011, we completed our offer to exchange the

Notes held by nonaffiliates for a new issue of substantially identical notes registered under the Securities Act of

1933, as amended.

Sears Canada Credit Agreement

In September 2010, Sears Canada entered into a five-year, $800 million Canadian senior secured revolving

credit facility (the “Sears Canada Facility”). The Sears Canada Facility is available for Sears Canada’s general

corporate purposes and is secured by a first lien on substantially all of Sears Canada’s non-real estate assets.

Availability under the Sears Canada Facility is determined pursuant to a borrowing base formula based on

inventory and account and credit card receivables, subject to certain limitations. At January 28, 2012, we had

approximately $101 million ($101 million Canadian) of borrowings outstanding under the Sears Canada Facility,

and classified these borrowings as long-term debt as we do not intend to repay outstanding amounts within the

next 12 months. Availability under this agreement, given total outstanding borrowings and letters of credit, was

approximately $415 million ($415 million Canadian) at January 28, 2012.

Letters of Credit Facility

On January 20, 2011, we and certain of our subsidiaries entered into a letter of credit facility (the “LC

Facility”) with Wells Fargo Bank, National Association (“Wells Fargo”), pursuant to which Wells Fargo may, on

a discretionary basis and with no commitment, agree to issue standby letters of credit upon our request in an

aggregate amount not to exceed $500 million for general corporate purposes. Any letters of credit issued under

the LC Facility are secured by a first priority lien on cash placed on deposit at Wells Fargo pursuant to a pledge

and security agreement in an amount equal to 103% of the face value of all issued and outstanding letters of

credit. The LC Facility has a term ending on January 20, 2014, unless terminated sooner pursuant to its terms.

Wells Fargo may, in its sole discretion, terminate the LC Facility at any time. At January 28, 2012, we had no

letters of credit outstanding under the facility. We may replace any letters of credit issued under our LC Facility

with letters of credit issued under the Amended Domestic Credit Agreement and as such, any cash collateral is

considered unrestricted cash.

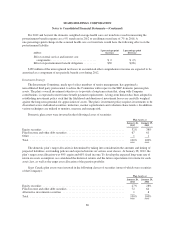

Cash Collateral

We post cash collateral for certain self-insurance programs. We continue to classify the cash collateral

posted for self-insurance programs as cash and cash equivalents due to our ability to substitute letters of credit for

the cash at any time at our discretion. At January 28, 2012 and January 29, 2011, $20 million and $324 million of

cash, respectively, was posted as collateral for self-insurance programs.

Wholly owned Insurance Subsidiary and Inter-company Securities

As noted in Note 1 of Notes to Consolidated Financial Statements, we have numerous types of insurable

risks, including workers’ compensation, product and general liability, automobile, warranty, and asbestos and

environmental claims. In addition, as discussed in Note 1, we sell extended service contracts to our customers.

The associated risks are managed through Holdings’ wholly owned insurance subsidiary, Sears Reinsurance

Company Ltd. (“Sears Re”), a Bermuda Class 3 insurer.

71