Sears 2011 Annual Report Download - page 67

Download and view the complete annual report

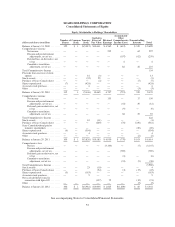

Please find page 67 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

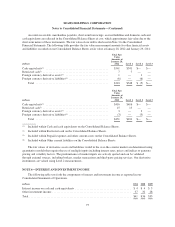

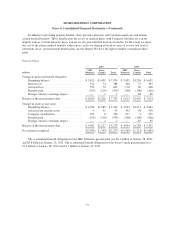

Notes to Consolidated Financial Statements—(Continued)

adoption is permitted. As this update only relates to financial statement presentation, we do not expect this

update to have a material effect on our results of operations, cash flows or financial position.

Disclosures about Fair Value Measurements

In May 2011, the FASB issued an accounting standards update which amends the definition of fair value

measurement principles and disclosure requirements to eliminate differences between U.S. GAAP and

International Financial Reporting Standards. The update requires new quantitative and qualitative disclosures

about the sensitivity of recurring Level 3 measurement disclosures, as well as disclosures of transfers between

Level 1 and Level 2 of the fair value hierarchy. The update will be effective for us in the first quarter of 2012 and

will primarily impact our disclosures, but otherwise is not expected to have a material impact on our consolidated

financial position, annual results of operations or cash flows.

NOTE 2—SEARS CANADA

Sears Canada Share Repurchases

During the second quarter of 2011, Sears Canada renewed its Normal Course Issuer Bid with the Toronto

Stock Exchange that permits it to purchase for cancellation up to 5% of its issued and outstanding common

shares, representing approximately 5.3 million common shares. The purchase authorization expires on May 24,

2012 or on such earlier date as Sears Canada may complete its purchases pursuant to the Normal Course Issuer

Bid. Sears Canada may not purchase common shares under the Normal Course Issuer Bid if they cannot be

purchased at prices that they consider attractive, and decisions regarding the timing of purchases will be based on

market conditions and other factors. Sears Canada purchased and cancelled approximately 2.7 million common

shares for $43 million and approximately 2.2 million common shares for $43 million during 2011 and 2010,

respectively.

Sears Holdings Ownership of Sears Canada

At January 28, 2012 and January 29, 2011, Sears Holdings was the beneficial holder of approximately

97 million, or 95% and 97 million, or 92% , respectively, of the common shares of Sears Canada.

Acquisition of Noncontrolling Interest

During the first quarter of 2010, we acquired approximately 19 million additional common shares of Sears

Canada. We paid a total of $560 million for the additional shares and accounted for the acquisition of additional

interest in Sears Canada as an equity transaction in accordance with accounting standards applicable to

noncontrolling interests. Accordingly, we reclassified an accumulated other comprehensive loss from

noncontrolling interest to controlling interest in the Consolidated Statement of Equity at January 29, 2011.

During 2009, we acquired approximately 0.5 million of Sears Canada’s common shares in open market

transactions. We paid a total of $7 million for the additional shares and accounted for the acquisition of

additional interest in Sears Canada as an equity transaction in accordance with accounting standards on

noncontrolling interests.

Dividends

On May 18, 2010, Sears Canada announced that its Board of Directors declared a cash dividend of $3.50

Canadian per common share, or approximately $377 million Canadian ($352 million U.S.), which was paid on

67