Sears 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

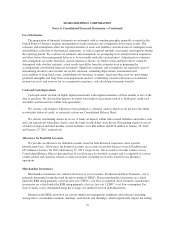

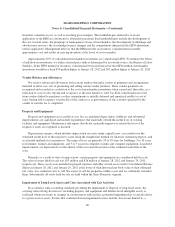

Notes to Consolidated Financial Statements—(Continued)

obligations have been met. We sell gift cards to customers at our retail stores and through our direct to customer

operations. The gift cards generally do not have expiration dates. Revenues from gift cards are recognized when

(i) the gift card is redeemed by the customer, or (ii) the likelihood of the gift card being redeemed by the

customer is remote (gift card breakage) and we determine that we do not have a legal obligation to remit the

value of the unredeemed gift cards to the relevant jurisdictions.

Revenues from merchandise sales and services are reported net of estimated returns and allowances and

exclude sales taxes. The reserve for returns and allowances is calculated as a percentage of sales based on

historical return percentages. Estimated returns are recorded as a reduction of sales and cost of sales. We defer

the recognition of layaway sales and profit until the period in which the customer takes possession of the

merchandise.

Cost of Sales, Buying and Occupancy Costs

Cost of sales, buying and occupancy are comprised principally of the costs of merchandise, buying,

warehousing and distribution (including receiving and store delivery costs), retail store occupancy costs, product

repair, and home service and installation costs, customer shipping and handling costs, vendor allowances,

markdowns and physical inventory losses.

The Company has a Shop Your Way Rewards program in which customers earn points on purchases which

may be redeemed to pay for future purchases. The expense for customer points earned is recognized as customers

earn them and recorded in cost of sales.

Selling and Administrative Expenses

Selling and administrative expenses are comprised principally of payroll and benefits costs for retail and

corporate employees, occupancy costs of corporate facilities, advertising, pre-opening costs and other

administrative expenses.

Pre-Opening Costs

Pre-opening and start-up activity costs are expensed in the period in which they occur.

Advertising Costs

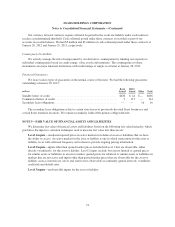

Advertising costs are expensed as incurred, generally the first time the advertising occurs, and amounted to

$1.9 billion, $2.0 billion and $1.9 billion for 2011, 2010 and 2009, respectively. These costs are included within

selling and administrative expenses in the accompanying Consolidated Statements of Operations.

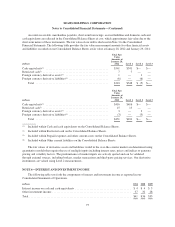

Income Taxes

We account for income taxes in accordance with accounting standards pertaining to such taxes.

Accordingly, we provide deferred income tax assets and liabilities based on the estimated future tax effects of

differences between the financial and tax basis of assets and liabilities based on currently enacted tax laws. The

tax balances and income tax expense recognized by us are based on management’s interpretation of the tax laws

of multiple jurisdictions. Income tax expense also reflects our best estimates and assumptions regarding, among

other things, the level of future taxable income, tax planning, and any valuation allowance. Future changes in tax

laws, changes in projected levels of taxable income, tax planning, and adoption and implementation of new

accounting standards could impact the effective tax rate and tax balances recorded by us. In evaluating our ability

65