Sears 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

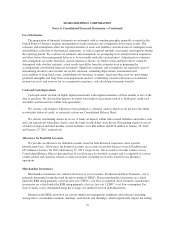

Notes to Consolidated Financial Statements—(Continued)

reporting unit. The projection uses management’s best estimates of economic and market conditions over the

projected period, including growth rates in sales, costs, estimates of future expected changes in operating margins

and cash expenditures. Other significant estimates and assumptions include terminal value growth rates, future

estimates of capital expenditures and changes in future working capital requirements. Our final estimate of fair

value of reporting units is developed by equally weighting the fair values determined through both the market

participant and income approaches.

If the carrying value of the reporting unit is higher than its fair value, there is an indication that impairment

may exist and the second step must be performed to measure the amount of impairment loss. The amount of

impairment is determined by comparing the implied fair value of reporting unit goodwill to the carrying value of

the goodwill in the same manner as if the reporting unit was being acquired in a business combination. See Notes

12 and 13 to the Consolidated Financial Statements for further information regarding goodwill and related

impairment charges recorded during 2011.

Intangible Asset Impairment Assessments

We consider the income approach when testing intangible assets with indefinite lives for impairment on an

annual basis. We utilize the income approach, specifically the relief from royalty method, for analyzing our

indefinite-lived assets. This method is based on the assumption that, in lieu of ownership, a firm would be willing

to pay a royalty in order to exploit the related benefits of this asset class. The relief from royalty method involves

two steps: (i) estimation of reasonable royalty rates for the assets and (ii) the application of these royalty rates to

a net sales stream and discounting the resulting cash flows to determine a value. We multiplied the selected

royalty rate by the forecasted net sales stream to calculate the cost savings (relief from royalty payment)

associated with the assets. The cash flows are then discounted to present value by the selected discount rate and

compared to the carrying value of the assets.

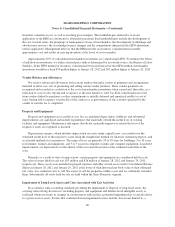

Financial Instruments and Hedging Activities

We are exposed to fluctuations in foreign currency exchange rates as a result of our net investment in Sears

Canada. Further, Sears Canada is exposed to fluctuations in foreign currency exchange rates due to inventory

purchase contracts denominated in U.S. dollars. As a result, we primarily use derivatives as a risk management

tool to decrease our exposure to fluctuations in the foreign currency market. We primarily use foreign currency

forward contracts to hedge the foreign currency exposure of our net investment in Sears Canada against adverse

changes in exchange rates and foreign currency collar contracts to hedge against foreign currency exposure

arising from Sears Canada’s inventory purchase contracts denominated in U.S. dollars.

Hedges of Net Investment in Sears Canada

When applying hedge accounting treatment to our derivative transactions, we formally document our hedge

relationships, including identification of the hedging instruments and the hedged items, as well as our risk

management objectives and strategies for undertaking the hedge transaction. We also formally assess, both at

inception and at least quarterly thereafter, whether the derivatives that are used in hedging transactions are highly

effective in offsetting changes in either the fair value or cash flows of the hedged item. If it is determined that a

derivative ceases to be a highly effective hedge, we discontinue hedge accounting.

For derivatives that are designated as hedges of our net investment in Sears Canada, we assess effectiveness

based on changes in spot currency exchange rates. Changes in spot rates on the derivatives are recorded in the

currency translation adjustments line in Accumulated Other Comprehensive Income and remain there until such

time that we substantially liquidate or sell our holdings in Sears Canada.

62