Sears 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

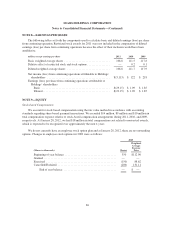

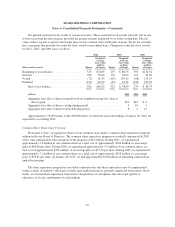

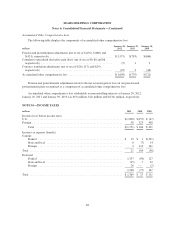

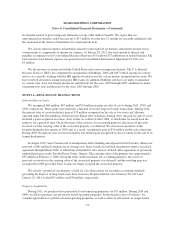

tax benefits related to gross temporary differences or any other indirect benefits. We expect that our

unrecognized tax benefits could decrease up to $17 million over the next 12 months for tax audit settlements and

the expiration of the statute of limitations for certain jurisdictions.

We classify interest expense and penalties related to unrecognized tax benefits and interest income on tax

overpayments as components of income tax expense. At January 28, 2012, the total amount of interest and

penalties recognized on our Consolidated Balance Sheet was $55 million ($37 million net of federal benefit). The

total amount of net interest expense recognized in our Consolidated Statement of Operations for 2011 was

$3 million.

We file income tax returns in both the United States and various foreign jurisdictions. The U.S. Internal

Revenue Service (“IRS”) has completed its examination of Holdings’ 2006 and 2007 federal income tax returns,

and we are currently working with the IRS appeals division to resolve certain matters arising from this exam. We

have resolved all matters arising from prior IRS exams. In addition, Holdings and Sears are under examination

by various state, local and foreign income tax jurisdictions for the years 2002 through 2009, and Kmart is under

examination by such jurisdictions for the years 2003 through 2009.

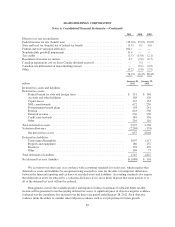

NOTE 11—REAL ESTATE TRANSACTIONS

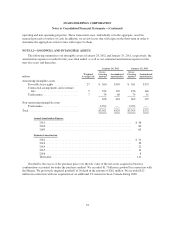

Gain on Sales of Assets

We recognized $64 million, $67 million, and $74 million in gains on sales of assets during 2011, 2010, and

2009, respectively. These gains were primarily a function of several large real estate transactions. During 2011,

the gain on sales of assets included a gain of $33 million recognized on the sale of two stores in California

operated under The Great Indoors format and one Kmart store in Indiana. During 2010, the gain on sales of assets

included a gain recognized on a Sears Auto Center we sold in October 2006, at which time we leased back the

property for a period of time. Given the terms of the contract, for accounting purposes, the excess of proceeds

received over the carrying value of the associated property was deferred. We closed our operations at this

location during the first quarter of 2010 and, as a result, recognized a gain of $35 million on this sale at that time.

During 2009, the gain on sales of assets included a $44 million gain recognized by Sears Canada on the sale of its

former headquarters.

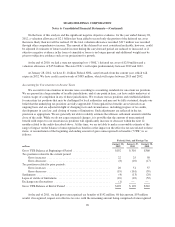

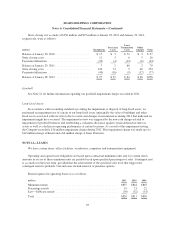

In August 2007, Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario for

proceeds of $81 million Canadian, net of closing costs. Sears Canada leased back the property under a leaseback

agreement through March 2009, at which time it finished its relocation of all head office operations to previously

underutilized space in the Toronto Eaton Centre, Ontario. The carrying value of the property was approximately

$35 million at February 2, 2008. Given the terms of the leaseback, for accounting purposes, the excess of

proceeds received over the carrying value of the associated property was deferred, and the resulting gain was

recognized in 2009 given that Sears Canada no longer occupied the associated property.

We classify a portion of our property as held for sale when criteria set out under accounting standards

governing the disposal of long-lived assets have been met. Property held for sale at January 28, 2012 and

January 29, 2011 totaled $55 million and $36 million, respectively.

Property Acquisitions

During 2011, we purchased five previously leased operating properties for $17 million. During 2010 and

2009, we did not purchase any previously leased operating properties. In the normal course of business, we

consider opportunities to purchase leased operating properties, as well as offers to sell owned, or assign leased,

91