Sears 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

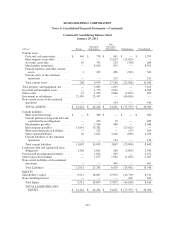

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

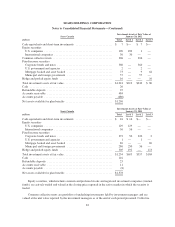

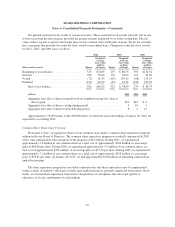

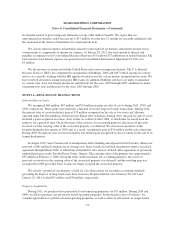

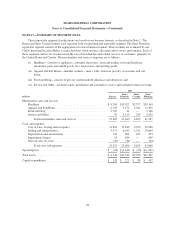

Changes in the carrying amount of goodwill by segment during years 2010 and 2011 are as follows:

millions

Sears

Domestic

Sears

Canada Total

Balance, January 30, 2010 and January 29, 2011:

Goodwill ....................................................... $1,097 $295 $1,392

2011 activity:

Impairment charges ............................................... (551) — (551)

Balance, January 28, 2012 .............................................. $ 546 $295 $ 841

In accordance with accounting standards for goodwill and other intangible assets, goodwill is not amortized

but requires testing for potential impairment, at a minimum on an annual basis, or when indications of potential

impairment exist. The impairment test for goodwill utilizes a fair value approach. The impairment test for

identifiable intangible assets not subject to amortization is also performed annually or when impairment

indications exist, and consist of a comparison of the fair value of the intangible asset with its carrying amount.

Identifiable intangible assets that are subject to amortization are evaluated for impairment using a process similar

to that used to evaluate other long-lived assets. Our annual impairment analysis is performed at the last day of

our November accounting period each year. See Note 13 for further information regarding our impairment

charges recorded in 2011.

We perform our annual goodwill and intangible impairment test required under accounting standards during

the fourth quarter of each year, or when an indication of potential impairment exists. The goodwill impairment

test involves a two-step process as described in the “Summary of Significant Accounting Policies” in Note 1. The

first step is a comparison of each reporting unit’s fair value to its carrying value. If the carrying value of the

reporting unit is higher than its fair value, there is an indication that impairment may exist and the second step

must be performed to measure the amount of impairment loss.

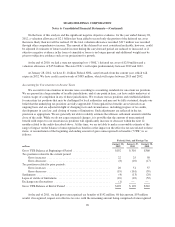

After performing the first step of the process, we determined goodwill recorded at reporting units within the

Sears Domestic segment were potentially impaired. The impairment charge was primarily driven by the

combination of lower sales and continued margin pressure coupled with expense increases which led to a decline

in our operating profit. After performing the second step of the process, we determined that the total amount of

goodwill recorded at these reporting units was impaired and recorded a charge of $551 million.

A significant amount of judgment is involved in determining if an indicator of impairment has occurred at a

date other than the annual impairment test date. Such indicators may include, among others: a significant decline

in our stock price and market capitalization; a significant adverse change in legal factors or in the business

climate; unanticipated competition; the testing for recoverability of a significant asset group within a reporting

unit; and slower growth rates. As noted in our Quarterly Report on Form 10-Q for the period ended October 29,

2011, management performed an interim assessment and concluded that there were no events or changes in

circumstances that indicated that it was more likely than not that the fair value for any reporting unit had declined

below its carrying value.

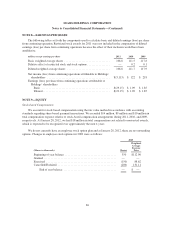

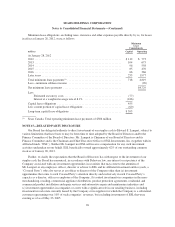

Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis

Assets and liabilities that are measured at fair value on a nonrecurring basis relate primarily to our tangible

fixed assets, goodwill and other intangible assets, which are remeasured when the derived fair value is below

carrying value on our Consolidated Balance Sheets. For these assets, we do not periodically adjust carrying value

to fair value except in the event of impairment. When we determine that impairment has occurred, the carrying

value of the asset is reduced to fair value and the difference is recorded within operating income in our

Consolidated Statements of Operations.

93