Sears 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

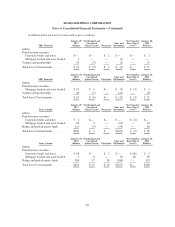

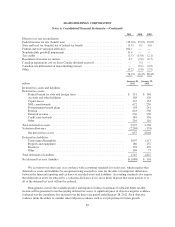

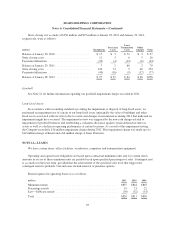

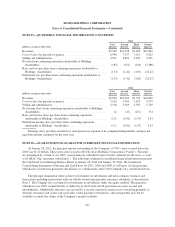

Store closing cost accruals of $256 million and $79 million at January 28, 2012 and January 29, 2011,

respectively, were as follows:

millions Markdowns

Severance

Costs

Lease

Termination

Costs

Other

Charges Total

Balance at January 30, 2010 ......................... $ 17 $ 3 $74 $ 3 $ 97

Store closing costs ................................ 12 3 6 5 26

Payments/utilizations .............................. (22) (4) (12) (6) (44)

Balance at January 29, 2011 ......................... 7 2 68 2 79

Store closing costs ................................ 130 73 5 46 254

Payments/utilizations .............................. (40) (16) (9) (12) (77)

Balance at January 28, 2012 ......................... $ 97 $59 $64 $36 $256

Goodwill

See Note 12 for further information regarding our goodwill impairment charges recorded in 2011.

Long-Lived Assets

In accordance with accounting standards governing the impairment or disposal of long-lived assets, we

performed an impairment test of certain of our long-lived assets (principally the value of buildings and other

fixed assets associated with our stores) due to events and changes in circumstances during 2011 that indicated an

impairment might have occurred. The impairment review was triggered by the non-cash charges related to

impairment of goodwill balances and establishing a valuation allowance against certain deferred income tax

assets as well as a decline in operating performance at certain locations. As a result of this impairment testing,

the Company recorded a $16 million impairment charge during 2011. This impairment charge was made up of a

$10 million charge at Kmart and a $6 million charge at Sears Domestic.

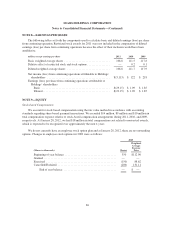

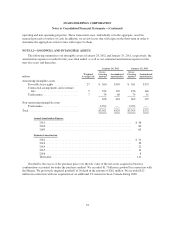

NOTE 14—LEASES

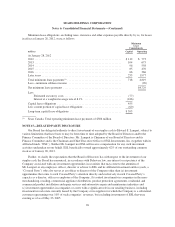

We lease certain stores, office facilities, warehouses, computers and transportation equipment.

Operating and capital lease obligations are based upon contractual minimum rents and, for certain stores,

amounts in excess of these minimum rents are payable based upon specified percentages of sales. Contingent rent

is accrued over the lease term, provided that the achievement of the specified sales level that triggers the

contingent rental is probable. Certain leases include renewal or purchase options.

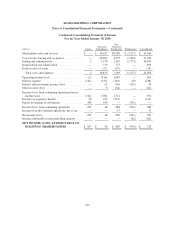

Rental expense for operating leases was as follows:

millions 2011 2010 2009

Minimum rentals ................................................ $837 $844 $865

Percentage rentals ............................................... 19 21 22

Less—Sublease rentals ........................................... (30) (52) (51)

Total ......................................................... $826 $813 $836

95