Sears 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

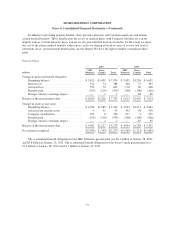

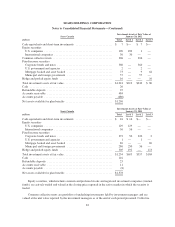

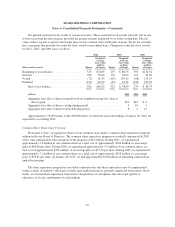

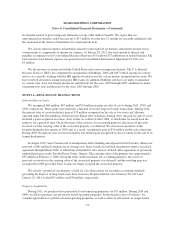

We granted restricted stock awards to certain associates. These restricted stock awards typically vest in one

to four years from the date of grant, provided the grantee remains employed by us at the vesting date. The fair

value of these awards is equal to the market price of our common stock on the date of grant. We do not currently

have a program that provides for restricted stock awards on an annual basis. Changes in restricted stock awards

for 2011, 2010, and 2009 were as follows:

2011 2010 2009

(Shares in thousands) Shares

Weighted-

Average

Fair Value

on Date

of Grant Shares

Weighted-

Average

Fair Value

on Date

of Grant Shares

Weighted-

Average

Fair Value

on Date

of Grant

Beginning of year balance ..................... 313 $74.09 279 $ 80.73 594 $134.32

Granted ................................... 386 59.60 176 83.09 110 54.90

Vested .................................... (72) 81.55 (110) 103.19 (86) 134.67

Forfeited .................................. (131) 61.62 (32) 81.38 (339) 152.59

End of year balance ...................... 496 $65.02 313 $ 74.09 279 $ 80.73

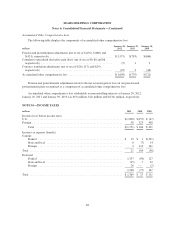

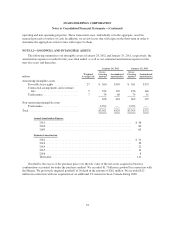

millions 2011 2010 2009

Aggregate fair value of shares granted based on weighted average fair value at

date of grant .................................................... $23 $15 $ 6

Aggregate fair value of shares vesting during period ...................... 5 10 5

Aggregate fair value of shares forfeited during period ..................... 8 2 14

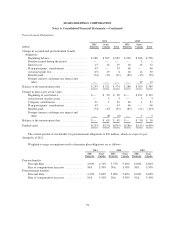

Approximately 156,000 shares of the 496,000 shares of restricted stock outstanding at January 28, 2012 are

expected to vest during 2012.

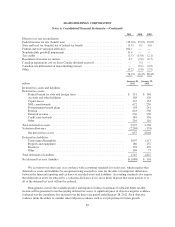

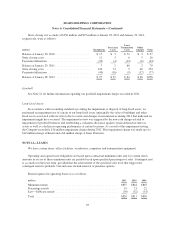

Common Share Repurchase Program

From time to time, we repurchase shares of our common stock under a common share repurchase program

authorized by our Board of Directors. The common share repurchase program was initially announced in 2005

with a total authorization since inception of the program of $6.5 billion. During 2011, we repurchased

approximately 2.8 million of our common shares at a total cost of approximately $183 million, or an average

price of $65.66 per share. During 2010, we repurchased approximately 5.5 million of our common shares at a

total cost of approximately $394 million, or an average price of $71.76 per share. During 2009, we repurchased

approximately 7.1 million of our common shares at a total cost of approximately $424 million, or an average

price of $59.81 per share. At January 28, 2012, we had approximately $504 million of remaining authorization

under this program.

The share repurchase program has no stated expiration date and share repurchases may be implemented

using a variety of methods, which may include open market purchases, privately negotiated transactions, block

trades, accelerated share repurchase transactions, the purchase of call options, the sale of put options or

otherwise, or by any combination of such methods.

87