Sears 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

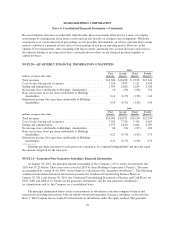

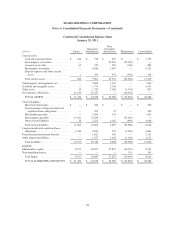

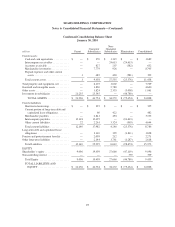

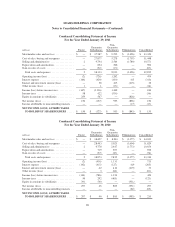

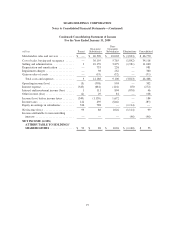

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

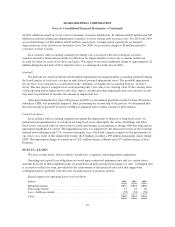

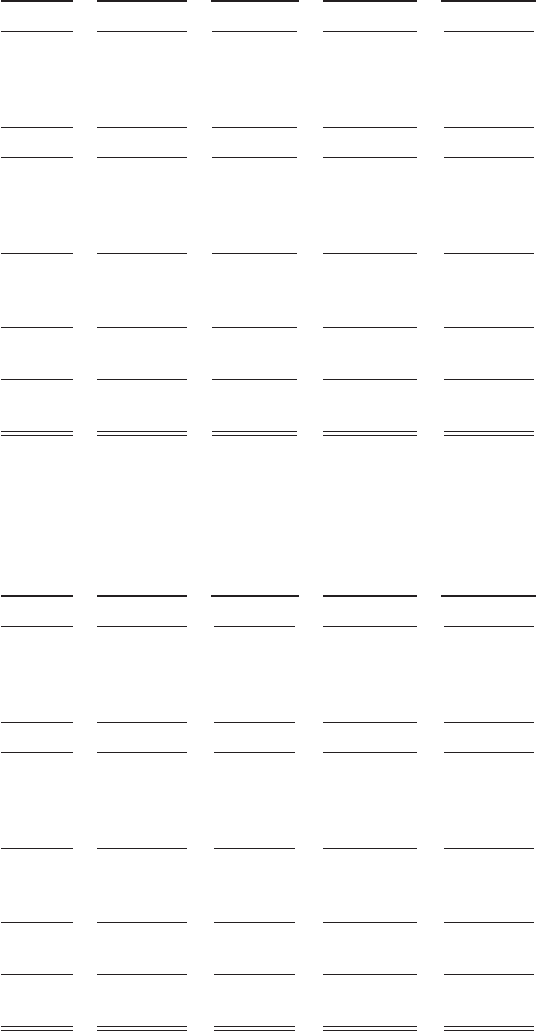

Condensed Consolidating Statement of Income

For the Year Ended January 29, 2011

millions Parent

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Merchandise sales and services .............. $ — $ 37,587 $ 9,235 $ (3,496) $ 43,326

Cost of sales, buying and occupancy .......... — 27,877 5,278 (1,707) 31,448

Selling and administrative .................. 2 9,794 2,564 (1,789) 10,571

Depreciation and amortization ............... — 694 206 — 900

Gain on sales of assets ..................... — (52) (15) — (67)

Total costs and expenses ................. 2 38,313 8,033 (3,496) 42,852

Operating income (loss) .................... (2) (726) 1,202 — 474

Interest expense .......................... (166) (429) (130) 415 (310)

Interest and investment income (loss) ......... — 38 413 (415) 36

Other income (loss) ....................... 1 1 (16) — (14)

Income (loss) before income taxes ............ (167) (1,116) 1,469 — 186

Income taxes ............................ 58 422 (516) — (36)

Equity in earnings in subsidiaries ............ 259 567 — (826) —

Net income (loss) ......................... 150 (127) 953 (826) 150

Income attributable to noncontrolling interests . . — — — (17) (17)

NET INCOME (LOSS) ATTRIBUTABLE

TO HOLDINGS’ SHAREHOLDERS ..... $ 150 $ (127) $ 953 $ (843) $ 133

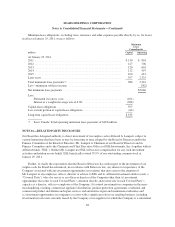

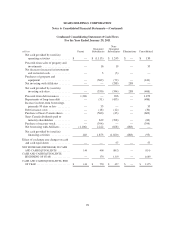

Condensed Consolidating Statement of Income

For the Year Ended January 30, 2010

millions Parent

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Merchandise sales and services .............. $ — $ 38,457 $ 8,963 $ (3,377) $ 44,043

Cost of sales, buying and occupancy .......... — 28,403 5,025 (1,604) 31,824

Selling and administrative .................. 2 9,778 2,647 (1,773) 10,654

Depreciation and amortization ............... — 719 207 — 926

Gain on sales of assets ..................... — (27) (47) — (74)

Total costs and expenses ................. 2 38,873 7,832 (3,377) 43,330

Operating income (loss) .................... (2) (416) 1,131 — 713

Interest expense .......................... (142) (415) (127) 419 (265)

Interest and investment income (loss) ......... — 42 410 (419) 33

Other income (loss) ....................... — 3 (64) — (61)

Income (loss) before income taxes ............ (144) (786) 1,350 — 420

Income taxes ............................ 50 292 (465) — (123)

Equity in earnings in subsidiaries ............ 391 540 — (931) —

Net income (loss) ......................... 297 46 885 (931) 297

Income attributable to noncontrolling interests . . — — — (62) (62)

NET INCOME (LOSS) ATTRIBUTABLE

TO HOLDINGS’ SHAREHOLDERS ..... $ 297 $ 46 $ 885 $ (993) $ 235

96