Sears 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

Sears Holdings Ownership of Sears Canada

At January 29, 2011 and January 30, 2010, Sears Holdings was the beneficial holder of approximately

97 million, or 92% and 79 million or 73%, respectively, of the common shares of Sears Canada.

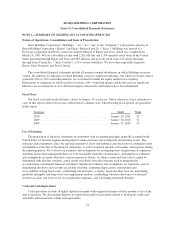

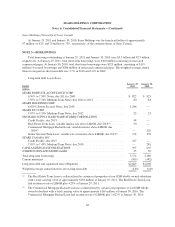

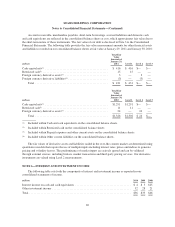

NOTE 3—BORROWINGS

Total borrowings outstanding at January 29, 2011 and January 30, 2010 were $3.5 billion and $2.5 billion,

respectively. At January 29, 2011, total short-term borrowings were $360 million consisting of unsecured

commercial paper. At January 30, 2010, total short-term borrowings were $325 million, consisting of $119

million of secured borrowings and $206 million of unsecured commercial paper. The weighted-average annual

interest rate paid on short-term debt was 3.7% in 2010 and 3.0% in 2009.

Long-term debt is as follows:

ISSUE

January 29,

2011

January 30,

2010

millions

SEARS ROEBUCK ACCEPTANCE CORP.

6.50% to 7.50% Notes, due 2011 to 2043.................................. $ 822 $ 823

7.05% to 7.50% Medium-Term Notes, due 2012 to 2013 ..................... 80 83

SEARS HOLDINGS CORP.

6.625% Senior Secured Notes, due 2018 .................................. 1,246 —

SEARS DC CORP.

9.07% to 9.20% Medium-Term Notes, due 2012 ............................ 23 23

ORCHARD SUPPLY HARDWARE STORES CORPORATION

Credit Facility, due 2013 .............................................. 48 —

Real Estate Term Loan, variable interest rate above LIBOR, due 2013(1) ......... 50 —

Commercial Mortgage-Backed Loan, variable interest above LIBOR, due

2010(2) ........................................................... — 120

Senior Secured Term Loan, variable rate of interest above LIBOR, due 2013(3) .... 174 176

SEARS CANADA INC.

Credit Facility, due 2015 .............................................. 107 —

7.05% to 7.45% Medium-Term Notes, due 2010 ............................ — 281

CAPITALIZED LEASE OBLIGATIONS ..................................... 597 635

OTHER NOTES AND MORTGAGES ....................................... 25 39

Total long-term borrowings ................................................ 3,172 2,180

Current maturities ........................................................ (509) (482)

Long-term debt and capitalized lease obligations ................................ $2,663 $1,698

Weighted-average annual interest rate on long-term debt ......................... 6.8% 6.6%

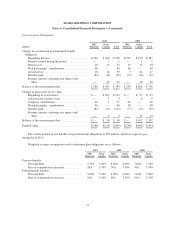

(1) The Real Estate Term Loan is collateralized by certain real properties of our OSH wholly owned subsidiary

with a total carrying value of approximately $158 million at January 29, 2011. The Real Estate Term Loan

had an interest rate of LIBOR plus 4.25% at January 29, 2011.

(2) The Commercial Mortgage-Backed Loan was collateralized by certain real properties of our OSH wholly

owned subsidiary with a total carrying value of approximately $169 million at January 30, 2010. The

Commercial Mortgage-Backed Loan had an interest rate of LIBOR plus 1.625% at January 30, 2010.

62