Sears 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We repurchased $394 million, $424 million and $678 million of our common stock pursuant to our common

share repurchase program in 2010, 2009 and 2008, respectively. The common share repurchase program was

initially announced in 2005 and has a total authorization since inception of the program of $6.0 billion. At

January 29, 2011, we had approximately $187 million of remaining authorization under the program. The share

repurchase program has no stated expiration date and share repurchases may be implemented using a variety of

methods, which may include open market purchases, privately negotiated transactions, block trades, accelerated

share repurchase transactions, the purchase of call options, the sale of put options or otherwise, or by any

combination of such methods.

Uses and Sources of Liquidity

Our primary need for liquidity is to fund working capital requirements of our retail businesses, capital

expenditures and for general corporate purposes, including debt repayment, pension plan contributions and

common share repurchases. We believe that these needs will be adequately funded by our operating cash flows,

credit terms received from vendors and borrowings under our credit agreements (described below). At

January 29, 2011, $2.2 billion was available under our domestic credit facility and $510 million under Sears

Canada’s credit facility.

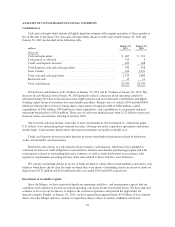

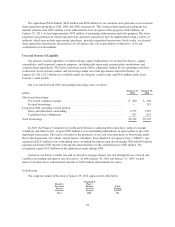

Our year end 2010 and 2009 outstanding borrowings were as follows:

millions

January 29,

2011

January 30,

2010

Short-term borrowings:

Unsecured commercial paper ........................................... $ 360 $ 206

Secured borrowings .................................................. — 119

Long-term debt, including current portion:

Notes and debentures outstanding ....................................... 2,575 1,545

Capitalized lease obligations ........................................... 597 635

Total borrowings ......................................................... $3,532 $2,505

In 2005, the Finance Committee of our Board of Directors authorized the repurchase, subject to market

conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or privately

negotiated transactions. The source of funds for the purchases is our cash from operations or borrowings under

the Credit Agreement. Our wholly owned finance subsidiary, Sears Roebuck Acceptance Corp. (“SRAC”), has

repurchased $215 million of its outstanding notes, including $6 million repurchased during 2009 and $49 million

repurchased during 2008, thereby reducing the unused balance of this authorization to $285 million. We

recognized a gain of $13 million on the repurchases made during 2008.

Certain of our debt is variable rate and we therefore manage interest rate risk through the use of fixed and

variable-rate funding and interest rate derivatives. At both January 30, 2010 and January 31, 2009, we had

interest rate derivatives with notional amounts of $120 million and nominal fair values.

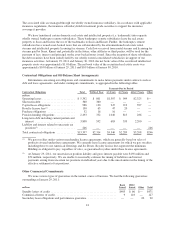

Debt Ratings

Our corporate family debt rating at January 29, 2011 appear in the table below:

Moody’s

Investors

Service

Standard &

Poor’s

Ratings

Services

Fitch

Ratings

Ba2 BB- B+

38