Sears 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

for uncertain tax positions that may be challenged by local authorities and may not be fully sustained, despite our

belief that the underlying tax positions are fully supportable. Unrecognized tax benefits are reviewed on an

ongoing basis and are adjusted in light of changing facts and circumstances, including progress of tax audits,

developments in case law, and closing of statute of limitations. Such adjustments are reflected in the tax

provision as appropriate. We are generally not able to reliably estimate the ultimate settlement amounts until the

close of the audit. While we do not expect material changes, it is possible that the amount of unrecognized

benefit with respect to our uncertain tax positions will significantly increase or decrease within the next 12

months related to the audits described above. At this time, we are not able to make a reasonable estimate of the

range of impact on the balance of unrecognized tax benefits or the impact on the effective tax rate related to these

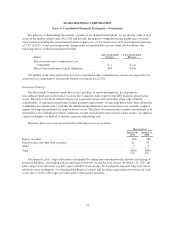

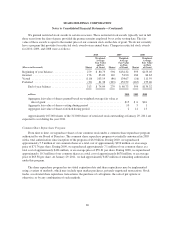

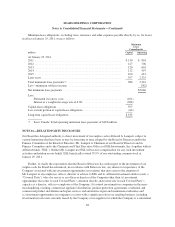

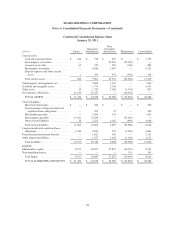

items. A reconciliation of the beginning and ending amount of gross unrecognized tax benefits (“UTB”) is as

follows:

Federal, State, and Foreign Tax

millions

January 29,

2011

January 30,

2010

January 31,

2009

Gross UTB Balance at Beginning of Period .......................... $310 $360 $ 454

Tax positions related to the current period:

Gross increases ............................................ 25 50 66

Gross decreases ............................................ (10) (17) (39)

Tax positions related to prior periods:

Gross increases ............................................ 51 57 136

Gross decreases ............................................ (161) (59) (238)

Settlements ................................................... (13) (29) (6)

Lapse of statute of limitations .................................... (10) (52) (13)

Gross UTB Balance at End of Period ............................... $192 $310 $ 360

At the end of 2010, we had gross unrecognized tax benefits of $192 million. Of this amount, $98 million

would, if recognized, impact our effective tax rate, with the remaining amount being comprised of unrecognized

tax benefits related to gross temporary differences or any other indirect benefits. We expect that our

unrecognized tax benefits could decrease up to $26 million over the next 12 months for tax audit settlements and

the expiration of the statute of limitations for certain jurisdictions.

We classify interest expense and penalties related to unrecognized tax benefits and interest income on tax

overpayments as components of income tax expense. At January 29, 2011, the total amount of interest and

penalties recognized on our consolidated balance sheet was $54 million ($35 million net of federal benefit). The

total amount of net interest income recognized in our consolidated statement of income for 2010 was $11 million.

We file income tax returns in both the United States and various foreign jurisdictions. The U.S. Internal Revenue

Service (“IRS”) has completed its examination of Holdings’ 2006 and 2007 federal income tax returns, and we

are currently working with the IRS appeals division to resolve certain matters arising from this exam. We have

resolved all matters arising from prior IRS exams. In addition, Holdings and Sears are under examination by

various state, local and foreign income tax jurisdictions for the years 2002-2008, and Kmart is under examination

by such jurisdictions for the years 2003-2008.

NOTE 12—REAL ESTATE TRANSACTIONS

Gain on Sale of Assets

We recognized $67 million, $74 million, and $51 million in gains on sales of assets during 2010, 2009, and

2008, respectively. These gains were primarily a function of several large real estate transactions. During 2010,

84